Today, high inflation and slowing economic growth have contributed to stagflation worries.

As of August 2022, the U.S. inflation rate has risen to 8.3%, above the central bank target of 2%. Yet unlike the last period of stagflation in the 1970s, unemployment – a key ingredient for stagflation – remains low.

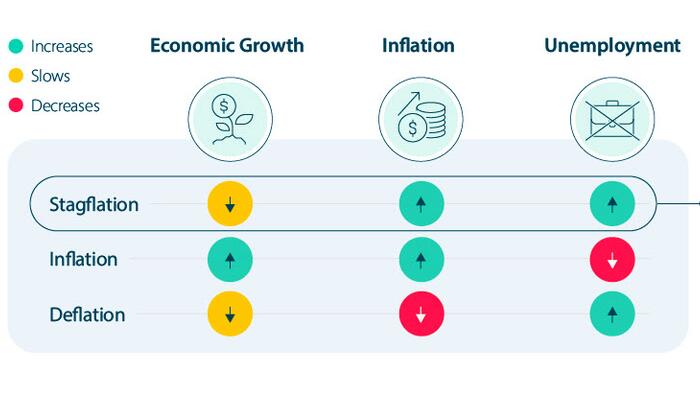

Visual Capitalist’s Dorothy Neufeld shows in this infographic from New York Life Investments, the key differences between stagflation, inflation, and deflation along with the broader economic implications of each.

Main Features of Inflationary Environments

What are the main characteristics of each inflationary scenario?

The key markers of stagflation are weak growth, persistent inflation, and structural unemployment—meaning that high unemployment levels continue beyond a recession.

In a stagflationary scenario, inflation expectations continue to rise each year. This can happen when inflation stays too high for too long, enough for expectations to shift across the economy. This was the case in the U.S. in the 1970s, until the Federal Reserve fought inflation with steep interest rate hikes.

Here’s a closer look at some of the main causes of each scenario and how they’ve historically impacted households and businesses.

1. Stagflation

The term stagflation is the combination of ‘stagnation’ and ‘inflation’.

The primary causes include the expansion of the money supply feeding into higher inflation, as well as supply shocks, which can drag on economic growth.

During periods of stagflation, consumers spend more on items such as food and clothing, while earning less—reducing their purchasing power. Less purchasing power can eventually cause people to buy less, leading to falling corporate revenues, which can ripple across the economy.

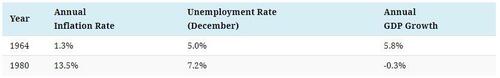

Case Study: 1970s Stagflation

The stagflation of the 1970s saw inflation, as measured by the Consumer Price Index, increase from 1% to 14% between 1964 and 1980.

Price pressures, driven by skyrocketing energy prices in the 1970s, contributed to a sharp economic downturn. By 1980, unemployment reached 7.2%.

In response, the Federal Reserve raised interest rates as high as 20% in 1981. Soon after, inflation sank to 5% by 1982 and unemployment levels improved.

2. Inflation

Inflation is the rise in the price of goods and services across the economy. Broadly speaking, low and stable inflation is associated with periods of economic growth and low unemployment. It can be driven by rising consumer demand.

The expectation of predictable inflation allows consumers and businesses to prepare for the future, in terms of both their purchases and investments.

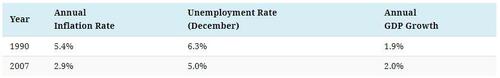

Case Study: 1990s-2000s

Over the 1990s and 2000s, the U.S. saw relatively low and stable inflation.

Rapid global population growth, the absence of oil shocks, and expanding global trade contributed to falling costs across industries. Between 1990 and 2007, inflation averaged 2.1% compared to 8.0% during the 1970s as price pressures became less volatile.

Today, several central banks adhere to a 2% inflation target to ensure prices remain stable and predictable.

3. Deflation

Deflation is the fall in prices of goods and services in the economy.

In many cases, its main causes are demand shortfalls, reduced output, or an excess of supply. For households, spending may stall as consumers wait for prices to fall. In turn, declining prices may lead to a lag in growth for businesses.

Sometimes, deflationary periods raise concerns of slower economic growth. However, supply-driven deflationary periods may be associated with lower prices, raising real incomes and boosting output as exports become more competitive.

Case Study: 1930s Great Depression

Prior to WWII, deflationary episodes were more common than today. One prime example is the Great Depression of the 1930s, when real GDP fell 30% between 1929 and 1933 and unemployment spiked to 25%.

Tightening monetary policy contributed to this environment. In fact, between 1930 and 1933, the U.S. money supply contracted roughly 30%, while average prices fell by a similar amount.

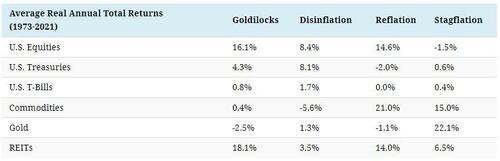

Historical Asset Class Performance

Which asset classes have historically tended to perform well across different types of inflationary environments?

Defensive assets like gold and commodities have historically performed well during stagflationary periods, with average returns of 22.1% and 15.0%, respectively.

Meanwhile, U.S. equities have typically performed well during moderate inflation, or ‘goldilocks’ environments, characterized by falling inflation and rising economic growth.

Both U.S. equities and Treasuries have shown the strongest real returns in deflationary or ‘disinflationary’ periods of slowing growth and inflation, at over 8% returns on average each.

Understanding Different Inflationary Environments

Today’s inflationary period is jarring for investors after an extended period of low and stable inflation. With this in mind, the economy has historically cycled through different types of inflationary periods.

While central banks aim to influence price stability and employment through monetary policy, investors can influence their portfolio by adjusting their asset allocation based on where the inflationary environment may be heading.

Read the full article here