Only a few Bitcoin (BTC) treasury companies will stand the test of time and avoid the vicious “death spiral” that will impact BTC holding companies that trade close to net asset value (NAV), a business entity’s total assets minus its liabilities, according to a report from venture capital (VC) firm Breed.

The health of Bitcoin treasury companies hinges on their ability to command a multiple of their net asset value (MNAV), the authors wrote.

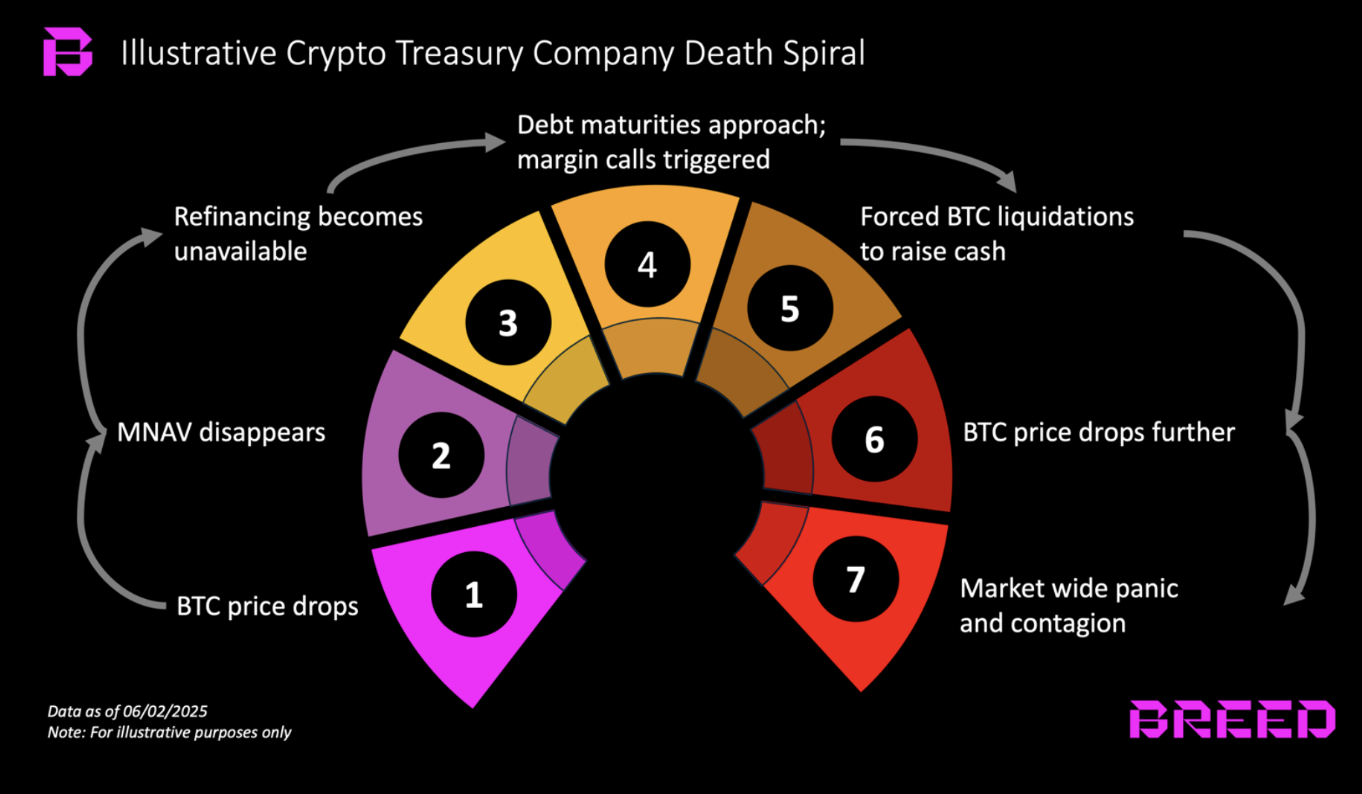

Breed’s report outlined the seven phases of a BTC treasury company’s decline, which begins with a drop in Bitcoin’s price that triggers a decline in MNAV, bringing a company’s share price close to its actual NAV.

This, in turn, makes it harder for BTC holding companies to secure the debt and equity financing critical to the asymmetric trade of converting the inflationary US dollar into a supply-capped appreciating asset.

As access to credit dries up and debt maturity looms, margin calls are triggered, forcing the firms to sell BTC into the market, lowering the price of BTC further, causing a consolidation of holding companies acquired by stronger firms, and potentially triggering a prolonged market-wide downturn. The authors of the report wrote:

“Ultimately, only a select few companies will sustain a lasting MNAV premium. They will earn it through strong leadership, disciplined execution, savvy marketing, and distinctive strategies that continue to grow Bitcoin-per-share regardless of broader market fluctuations.”

This death spiral could trigger the next crypto bear market. However, the authors of the report said that since most BTC treasury companies currently finance their purchases with equity rather than debt, the implosion may be contained.

Equity-based financing limits the fallout in the broader market, the authors said. Despite this, the current forecast could change if debt financing overtakes equity as the more popular option.

Related: Michael Saylor’s Strategy premium is not ‘unreasonable’: Adam Back

Bitcoin treasury companies become a major trend in 2025

Michael Saylor’s company, Strategy has been purchasing Bitcoin since 2020 and popularized the BTC corporate treasury concept, which gained significant steam in the last two years.

Over 250 organizations now hold Bitcoin, including corporations, government entities, exchange-traded funds (ETFs), pension funds, and digital asset service providers, according to BitcoinTreasuries.

Magazine: Baby boomers worth $79T are finally getting on board with Bitcoin

Read the full article here