Bitcoin retail investors are snapping up Bitcoin as whales sell off, a pattern that could signal trouble for the asset’s price if history is any guide, according to sentiment platform Santiment.

However, other crypto analysts are divided on how the coming weeks will unfold for Bitcoin (BTC).

“Historically, prices tend to follow the direction of the whales, not retail,” Santiment said in a markets report on Saturday.

Santiment pointed out that since Oct. 12, Bitcoin whales — wallets holding between 10 and 10,000 BTC — have sold approximately 32,500 Bitcoin. However, Santiment added that “small retail wallets have been aggressively buying the dip.”

Bitcoin’s split among the cohorts is a “cautionary signal,” says Santiment

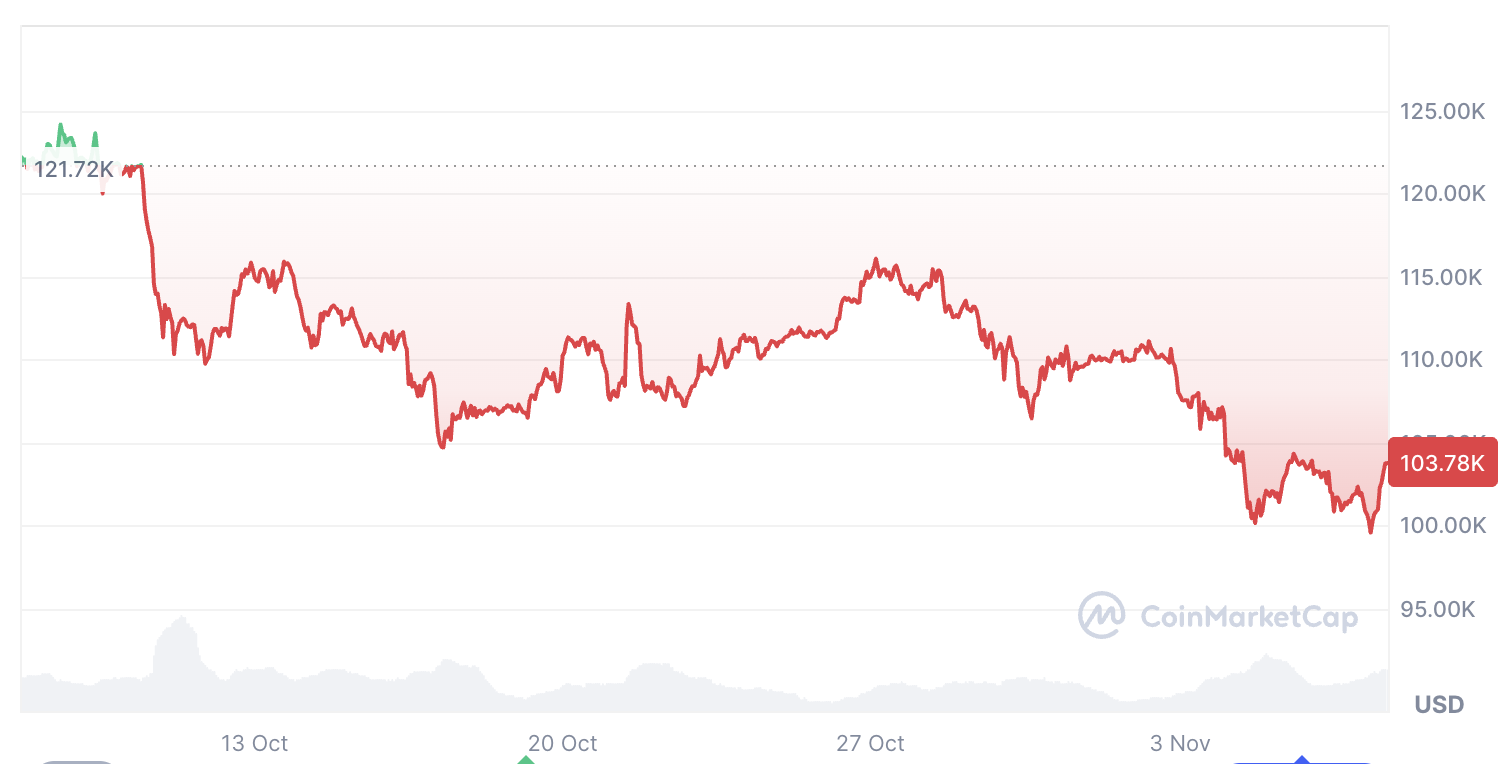

During that time, Bitcoin fell from $115,000 to $98,000 on Nov. 4, representing a decline of around 15%, according to CoinMarketCap. BTC’s price has since recovered to $103,780 at the time of publication.

Santiment described it as a “major divergence has appeared between large and small investors.” Santiment said:

“A divergence where whales are selling while retail is buying can be a cautionary signal.”

Other analysts are divided on how the coming weeks will play out for Bitcoin.

Bitfinex analysts told Cointelegraph that they expect near-term consolidation and some volatility, rather than “a clear sprint to new highs.”

“We believe ETF inflows earlier in October pushed the price to around $125,000, before mid-month macro shocks, a major options expiry, and profit-taking knocked it back into the high $100,000s,” the analysts said.

On Friday, spot Bitcoin ETFs broke a six-day outflow streak that saw $2.04 billion in outflows, according to Farside.

Bitcoin has a chance of climbing to $130,000 if conditions improve: Analysts

They explained that if spot Bitcoin ETF inflows return to delivering above $1 billion inflows per week and macro conditions improve, Bitcoin may have a chance to climb toward $130,000.

Related: Bitcoin crisscrosses $100K as BTC price ‘bottoming phase’ begins

Meanwhile, Nansen senior research analyst Jake Kennis told Cointelegraph that although Bitcoin has historically posted year-over-year gains, “the recent liquidation and breakdown in market structure make it far less probable in the near term.”

“That said, there’s still room for meaningful upside into year-end,” Kennis said, explaining that a new all-time highs are still possible for Bitcoin this year if momentum does “shift decisively.”

Magazine: Grokipedia: ‘Far right talking points’ or much-needed antidote to Wikipedia?

Read the full article here