Key points:

-

Bitcoin is working on completing a “successful” support retest as trader bets increase prior to the weekly candle close.

-

BTC price volatility is expected as liquidity analysis shows that conditions favor a significant short squeeze.

-

$100,000 still remains a likely target in the event of a fresh price dip.

Bitcoin (BTC) held $105,500 toward the June 8 weekly close amid hopes that the BTC price correction was over.

Bitcoin liquidation risk rises as price coils at $105,000

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD cementing its rebound after a trip to $100,500 on June 5.

Now almost back at its weekly open level, Bitcoin again inspired traders to bet on upside continuation and resumption of the bull run.

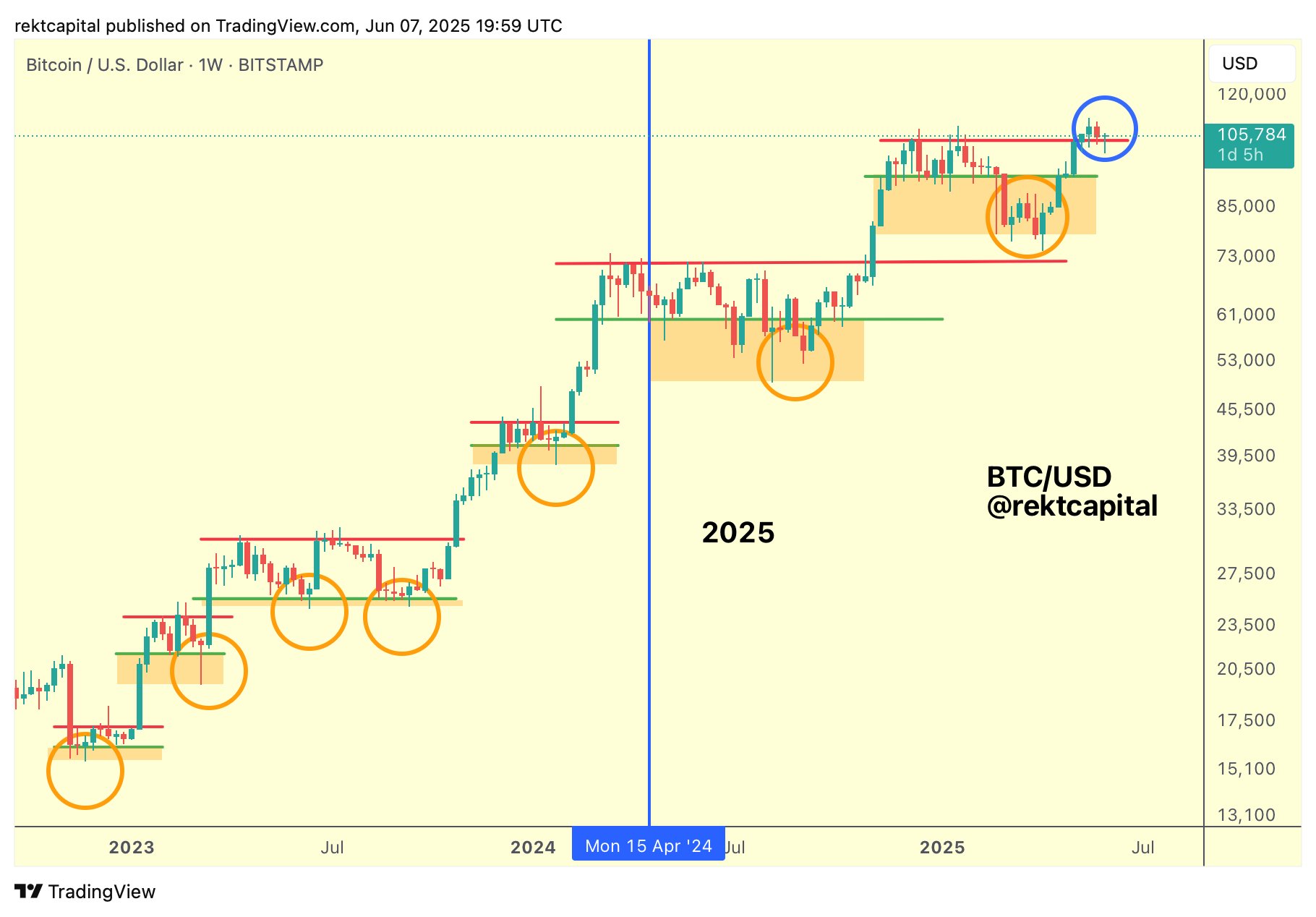

“On the Daily timeframe, Bitcoin is showcasing signs of breaking its two-week Downtrend (light blue) while also turning it into support earlier today,” popular trader and analyst Rekt Capital told X followers while uploading a chart with key levels.

“Daily Closing & retesting ~$106600 (black) would be even better to enable trend continuation.”

BTC price action had already achieved a daily close above its 10-day simple moving average (SMA) — something that fellow trader SuperBro had said was a prerequisite to “invalidate the bear case.”

$BTC still needs to reclaim the 10 MA and H&S neckline on a closing basis to invalidate the bear case

until then, this is not the place to get aggressive with longs, the time for that was the retest of the FVG and 50 MA, when you were so sure it was all over 😂 pic.twitter.com/TAEG3wZgOM

— Super฿ro (@SuperBitcoinBro) June 7, 2025

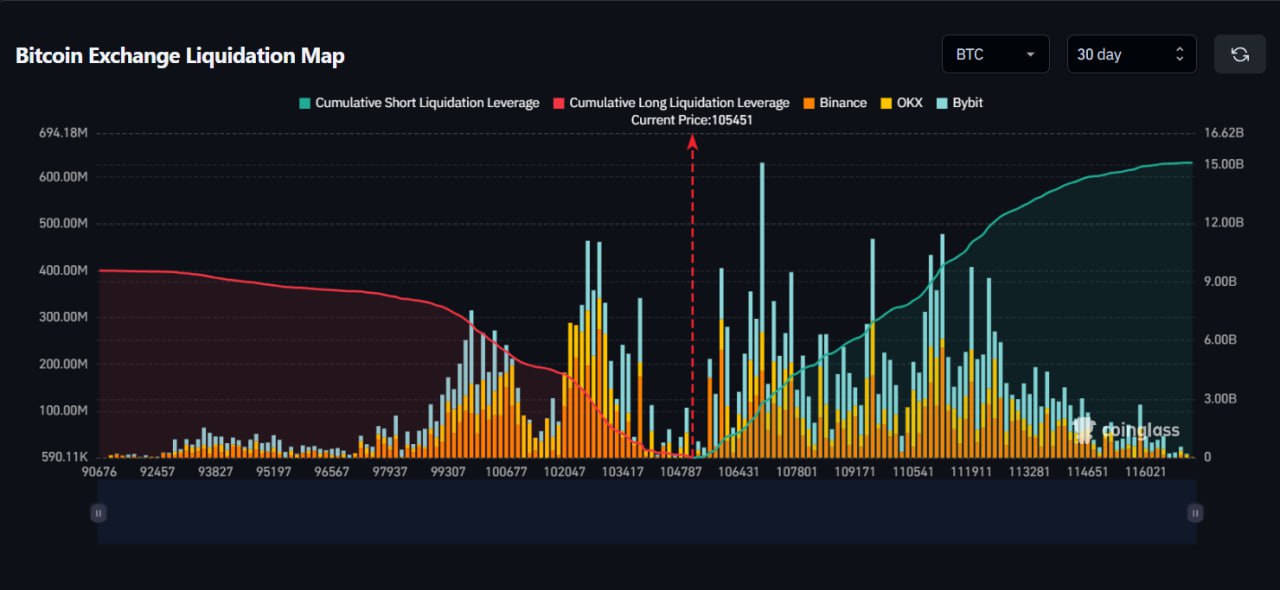

Trader Cas Abbe meanwhile looked to order book liquidity for cues over price direction.

This was building both above and below spot price, leading Abbe to predict a magnet-style move to “grab” it.

“BTC liquidation cluster is now signalling an upside move,” he summarized on X.

“If BTC pumps 10% from here, $15.11 billion in shorts will get liquidated. Meanwhile a 10% downside move will liquidate $9.58 billion in longs.”

Abbe noted that negative funding rates pointed to “big short positions” appearing over the weekend.

“I think BTC big move is coming next week, possibly pushing it above $109K-$110K,” he concluded.

$104,400 now key weekly close level

Some saw the potential for further support retests first.

Related: Bitcoin nears $105K as Donald Trump demands ‘full point’ Fed rate cut

Updating X followers on his market forecast, popular trader CrypNuevo saw the logical place to build long BTC positions at $100,000.

“100k is the strongest psychological support so, as explained on Sunday, it’s the area where I’m building some longs with easy invalidation below it,” he wrote, referring to his previous aim of tagging the $100,000 mark.

Rekt Capital meanwhile described the support retest after May’s all-time highs on weekly timeframes as “successful.”

“Can Bitcoin successfully confirm this retest with a Weekly Close above $104400 for what would be a 4th week in a row?” he queried.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here