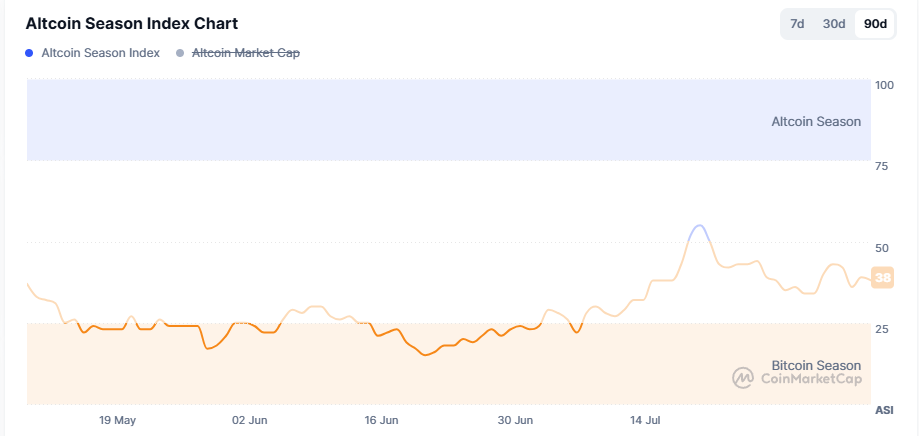

There’s probably nothing more reliable in crypto than traders yelling “ALTSEASON IS HERE” every time Bitcoin stumbles against altcoins.

Heck, they’ve been saying it religiously since mid-2024, and they’re starting to do it again now after Bitcoin dominance fell under 60% over the weekend, its lowest level since February.

Except this time, they may be onto something; ETH is within sight of new all-time highs, and other altcoins are looking ready to pounce.

“We may be in the middle of the Bitcoin cycle and in the early stage of an altcoin cycle,” Martin Burgherr, Sygnum Bank’s chief client officer, tells Magazine.

“Bitcoin dominance remains high but has started to slip, signaling early rotation into altcoins.”

There’s some data to back this up. Worldwide interest in the word “altcoin” on Google search is at its highest point since the end of last year. In the US, it’s the highest it’s been in about seven years. Meanwhile, Ether is up over 60% in the last 12 months — which usually heralds a rotation into alts.

Altcoin summer could have cold spots

But this altseason looks set to play out very differently from usual. Analysts tell Magazine that only certain altcoins will pump and that timing the peak will be a lot more difficult than before.

“This cycle’s [altseason…] is likely to be more selective and will see narrative-driven runs (e.g., AI, RWAs) rather than all altcoins rising together,” says Jag Kooner, head of derivatives at Bitfinex.

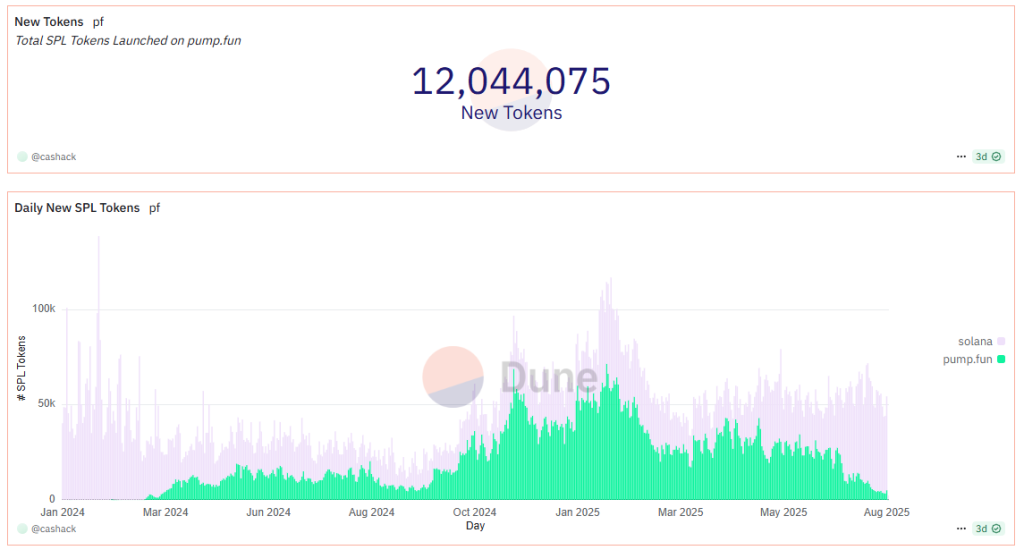

Kooner said a big factor is a massive oversupply of tokens, which at one point involved 50,000 new tokens per day in the market diluting gains, driven by memecoin dominance.

“I don’t think it will be ‘the rising tide raises all ships,’” agrees crypto trader and technical analyst Craig Cobb of Altseason 2025.

“There’s just too much dilution. You know, back then, we might have had 5,000 coins. Now we’re probably getting about 5,000 a freaking day because the devil entered our space.”

“The devil is Pump.Fun, a liquidity extraction device for the get-rich-quick era.”

Pump.Fun launched in January 2024, allowing anyone with a basic understanding of crypto to create their own memecoin. At its peak, users of the platform launched more than 70,000 tokens in a single day, and the platform is responsible for adding 12 million useless tokens to our ecosystem to date.

Institutional bid fuels different kind of altseason

At the other end of the spectrum, Wall Street money is also being directed toward a select group of cryptocurrencies in a way that didn’t exist before.

Spot Bitcoin and Ether exchange-traded funds, which launched in 2024, have provided a regulated vehicle for massive pension funds and big banks to invest in cryptocurrency, funneling over $62 billion of total net inflows into these ETFs since their launch. (The vast majority into Bitcoin.)

Crypto treasury firms that sell shares or issue debt to raise funds to amass their chosen cryptocurrency have popped up like wildflowers to throw money at the likes of Bitcoin, Ether, Solana, BNB, Toncoin, Tron and Sui.

“Institutions are taking a more measured approach, favoring compliance‑ready assets with deeper liquidity rather than chasing every speculative token,” Burgherr says.

“Macro conditions and the rise of crypto ETFs are also shaping flows, meaning we should expect a more mature, less euphoric pattern compared to past cycles. The focus is on quality and long‑term utility, not just momentum,” he adds.

Altseason bull run could be shorter and softer

The concentration of TradFi capital into Bitcoin and Ether could also mean that altcoin market peaks and troughs will be far more difficult to spot.

“We see fewer retail-fuelled rallies and shallower corrections (20%-30% vs. 50%+) and sector rotations, driven by regulatory clarity and maturing market depth,” says Kooner, adding that the push into Bitcoin and Ether ETFs will prolong Bitcoin’s lead and reduce volatility.

Burgherr says he expects this altseason to last around two to three months and that the rotation will happen once Bitcoin consolidates after strong gains and risk appetite shifts outward.

“The peak will be driven by a mix of macro sentiment, institutional inflows into select altcoins and retail enthusiasm, but the window is finite, and timing is critical for capturing outsized returns.”

Kooner expects the next altseason to last a bit longer, at four to five months, potentially starting this year and peaking in the fourth quarter of 2025 or early 2026.

“The peak might align with global liquidity cycles topping in Q4, but volatility from policy shifts could shorten it. Traders should remain vigilant.”

Crypto trader Cobb says the higher they go up, the further they have to fall, meaning opportunities will abound for short sellers.

“I’m immensely excited for when this is over. The higher these alts go, the better because there’s going to be an absolute bloodbath.”

Cobb likened some crypto projects to Pets.com, the famed company that exploded during the dot-com bubble after investors caught wind of its disastrous business model.

“While there is plenty [of opportunity] on the upside, the biggest one is going to be shorting these projects that have no revenue […] they’re going to go boom.”

Altseason, more like hopium season

But some analysts don’t believe there will be an alt season at all.

Nicolai Søndergaard, research analyst at Nansen, explains that many crypto investors have been sidelined from Bitcoin and are now heavily exposed to languishing alts.

“A lot of people have been burned, and that’s also why a lot of people are calling for altseason. You know, you want to make back a lot of what you’ve lost. You’re kind of in this belief stage where you’re like, you’re hoping.”

But Søndergaard argues most altcoins will be hamstrung without institutional interest, given retail is staying on the sidelines for now.

“Institutions, I suppose, aren’t allowed to just throw money at altcoins or tokens below [a million] market cap. So, they’re not really allowed to play in these kind of ball fields,” he explains.

Read also

Features

Can blockchain solve its oracle problem?

Features

Experts want to give AI human ‘souls’ so they don’t kill us all

“If I look outside of the crypto circle, there’s this hesitancy to go back into the crypto space. I think that’s a large part of why we won’t necessarily see the same altcoin season with exuberance for everything where you just throw money at something and it just goes up.”

“It really will be more of a selective altcoin season, if anything.”

Markus Thielen, head of research at 10x Research, also doesn’t think there will be an altseason at all.

“So, this altcoin season that many people have been trying to call for the last, you know, 12 to 18 months, like constantly, as soon as there’s a little pop. I don’t think that’s going to be sustainable.”

Thielen explains that compared to past bull markets, there hasn’t been a strong narrative driving altcoins.

“There was a DeFi narrative, and of course, there was the NFT narrative. The NFT narrative, you know, required Ethereum. You needed to mint the NFTs. You needed Ethereum to buy them and everything … Bored Apes were priced in Ethereum and all these things. So, but right now, the use case is simply not there.”

“Vitalik is more busy adopting hippos than anything else these days. So, there is no narrative.”

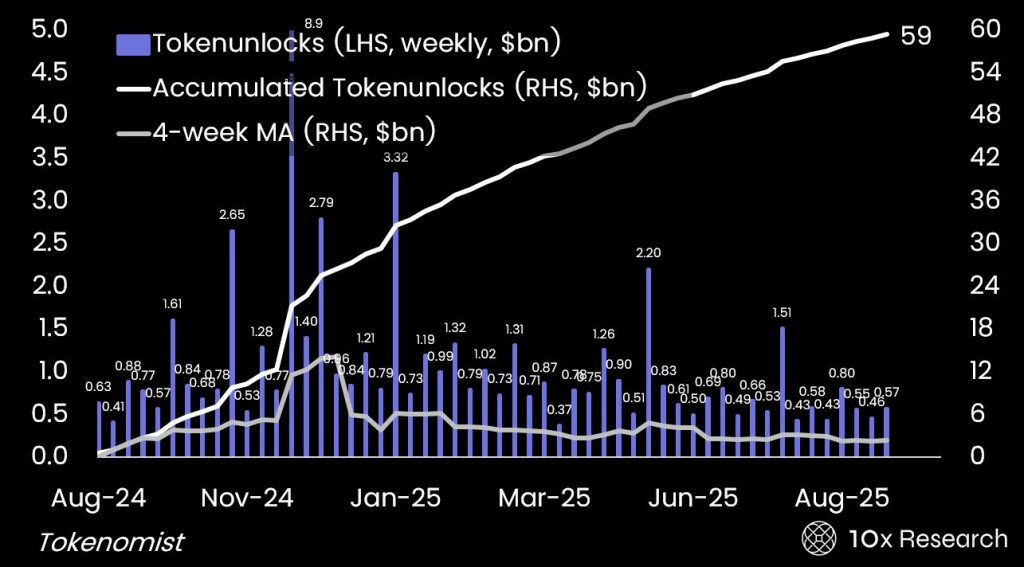

Thielen also notes there is “about $59 billion of unlocks happening in the altcoin market a year, which is quite a lot.”

“I think that a lot of these … venture funds that invested in those rounds a couple of years ago want their money back because the big theme is AI. It’s no longer crypto.”

But even if altseason isn’t imminent, Søndergaard believes one will happen sooner or later.

“If we have a more, let’s say, positive monetary environment, we have geopolitical events that aren’t weighing on people’s minds, and people aren’t financially struggling. That’s when we would probably see a larger revival of what we’ve seen in the past as altcoin seasons.”

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Felix Ng

Felix Ng first began writing about the blockchain industry through the lens of a gambling industry journalist and editor in 2015. He has since moved into covering the blockchain space full-time. He is most interested in innovative blockchain technology aimed at solving real-world challenges.

Read the full article here