Dphotographer

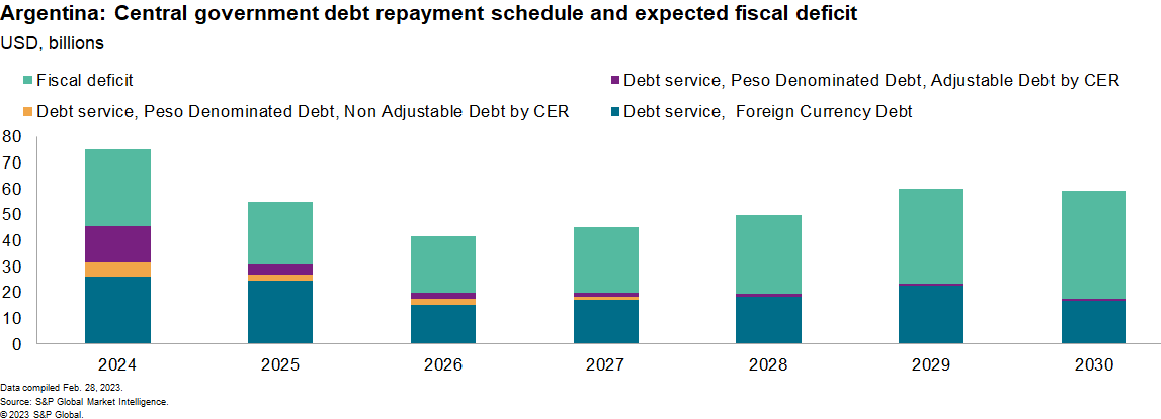

Argentina’s public debt has grown by USD73 billion in the past three years to USD394 billion – notably expanding in 2021-22 – even with supervision from the International Monetary Fund (IMF). More than half of the increase can be attributed to the stock of inflation-linked local currency debt.

For the next two political terms, Argentina’s next two governments will face heavy external debt service requirements, with the highest burden in 2028-30. This stems from the 2020 external debt restructuring and the 2022 agreement with the IMF to reschedule its IMF borrowings using a 10-year Extended Fund Facility (EFF) worth USD44.5 billion. The program does not demand rapid deep-rooted economic adjustment but instead seeks a gradual approach, designed to improve the likelihood of compliance.

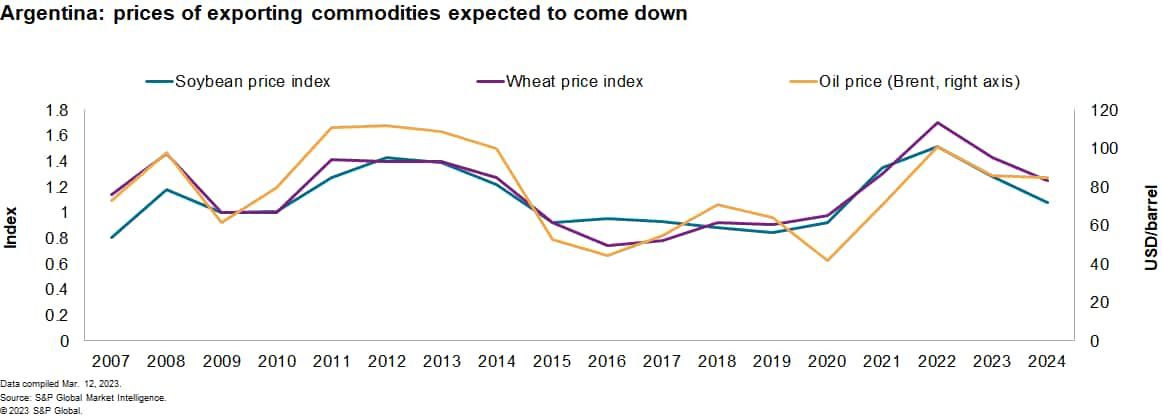

Exports, fiscal revenues will be damaged by softer commodity prices and lower agricultural production

Although commodity prices are projected to remain relatively high versus 2014-19 levels, Market Intelligence forecasts declines in agricultural prices from their 2022 peak by 15% in 2023 and 16% in 2024. Within this, prices of corn and wheat are also projected to decline, as commodity prices adjust to the Russian invasion of Ukraine and slower global economic growth.

Revenues will be further restricted by lower production volumes reflecting the La Niña adverse weather pattern. Drought conditions during the planting season reduced early corn planting areas, threatening yields; wheat production has been damaged both by frosts and drought. With nearly 50% of the country under a degree of drought, Rosario’s Grain Exchange Agency estimates that soybean production will fall to 34.5 million tons – 18% less than the already weak volumes in the 2021-22 season. Overall, output projections for Argentina’s main crops have been reduced for the 2022-23 season. Exports of primary products and manufactured goods of agricultural origin retain a dominant share within total exports (64.4% in 2022).

Debt management is an ongoing problem, exacerbated by electoral considerations

The government has already faced debt stress this year, having needed to extend maturities on short-term debt instruments to move repayments into the second half of the year and 2024. The electoral cycle hinders scope for fiscal consolidation efforts to ease these pressures, heightening the potential political cost of removing or reducing utility subsidies or curtailing social spending. However, maintaining or expanding such spending for electoral reasons will reduce the likelihood of compliance with the IMF’s program targets for 2023.

Candidates for the Oct. 22 presidential election will be chosen in primary elections (PASO) on Aug. 13. Almost all the candidates are likely to continue to reduce gas and electricity subsidies, albeit at different speeds. Cuts would be implemented faster under Milei, more gradually under the center-right opposition Together for Change (Juntos por el Cambio: JxC) or a moderate Peronist, and would face delay – particularly for the low-income segment of the population – under a Kirchnerist president, who would be likely to seek to protect the core support base for Kirchnerism. So far, polls have shown JxC holding a slight lead.

Growing banking sector exposure to government debt indicates future risk accumulation

Although near-term damage appears limited, the banking sector is under pressure to increase its exposure to domestic sovereign debt. The lack of access to international financial markets has led the government to become more reliant on domestic banks to finance a growing part of its fiscal deficit, alongside monetary expansion (printing money).

Argentina faces a dilemma over efforts to sell debt to its banking system. If it allows bank holdings of state debt to run off and instead reverts to monetary expansion, this would lead to rapid growth of the money supply, boosting inflation and weakening the value of the peso. Conversely, if it seeks to restrict recourse to “printing money” by selling more to banks, potentially driving such sales by regulatory changes, it would increase bank exposure to the state, in turn increasing financial asset quality and solvency risks if domestic debt faces future rescheduling.

Fundamental solutions will be hard to achieve

Near-term economic prospects appear likely to deteriorate. These include extreme inflation (at an annual triple-digit rate in February 2023), loss of confidence in the local currency, price misalignment because of its complicated multi-tier exchange rate system and capital controls, a decline in export revenues from agricultural commodities, an increased subsidy burden for utility services, and fiscal spending pressures – all combined with being in a presidential election year.

Argentina still lacks – and previously has shown little domestic political enthusiasm for – a comprehensive plan to reduce the fiscal deficit and steer the country towards a sustainable debt path, with its main current discipline coming from the conditionality built into its EFF program from the IMF.

Argentina’s unresolved macroeconomic imbalances are a core challenge for the next administration and increase the risk of future default, including further efforts to seek relief from the IMF. In turn, this risk will hinder economic development.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here