Strategy founder Michael Saylor said COVID-19-era restrictions and US central bank monetary policy at the time are what ultimately motivated him to invest in Bitcoin in 2020.

During an interview with Jordan B. Peterson that aired on Monday, Saylor said he became deeply interested in Bitcoin (BTC) in 2020 following what he called a “war on currency” amid pandemic-induced global lockdowns and diminished interest rates in the United States.

“It wasn’t the war on COVID, it was the war on currency,” he told Peterson.

In an email to employees at the time, Saylor wrote that the COVID-19 restrictions were “soul-stealing and debilitating to embrace the notion of social distancing and economic hibernation.”

He described the year 2020 as a “bifurcation of Main Street and Wall Street,” where small and medium-sized businesses and workers were “destroyed” by restrictive policies that shut down stores and workplaces, while investors and Wall Street fatcats were doing very well.

Saylor said his only lifeline was $500 million in cash reserves held by MicroStrategy, but interest rates were near zero due to Federal Reserve intervention, so that cash did not earn a yield.

“Central banks were printing money,” he said, “forcing rates down.”

Money printing mayhem

“COVID lockdown takes place and there is a massive panic,” but the most “perverse thing imaginable” was that stock markets had recovered by the summer of 2020 because the Federal Reserve was printing money.

“We had hyperinflation in financial assets,” which made investment managers and stock traders rich, he said.

Related: Centralized Bitcoin treasuries hold 31% of BTC supply: Gemini

“I had an asset [cash] that was now non-performing […] so I have a choice between a fast death or a slow death, and so it was time to make a decision to choose a side.”

The war on currency

“It took me 30 years to accumulate the money […] why should I give up 30 years of my life,” Saylor lamented.

This was when he started looking for a solution, stating, “I want to be one of those guys who owns things, but I don’t want to own sovereign debt.”

Saylor considered real estate, stock portfolios and even collectible art as investments, but the first two had already skyrocketed due to the zero-interest rate environment.

“How do I find $500 million worth of Picassos and Monets attractively priced?” he asked.

“I need a liquid fungible asset which will store my economic energy for an indefinite period of time.”

Bitcoin investments begin

“I’m watching the world burn while all the Wall Street guys get rich,” he said before asking his long-term friend and founder of Blockchain Investment Group, Eric Weiss, about Bitcoin and crypto, which he originally thought was a “scam coin” during the 2018 bear market.

Saylor started studying crypto using YouTube videos, podcasts, and books and came to the opinion that the solution was a “non-sovereign store of value bearer instrument of which gold had been the best of those.”

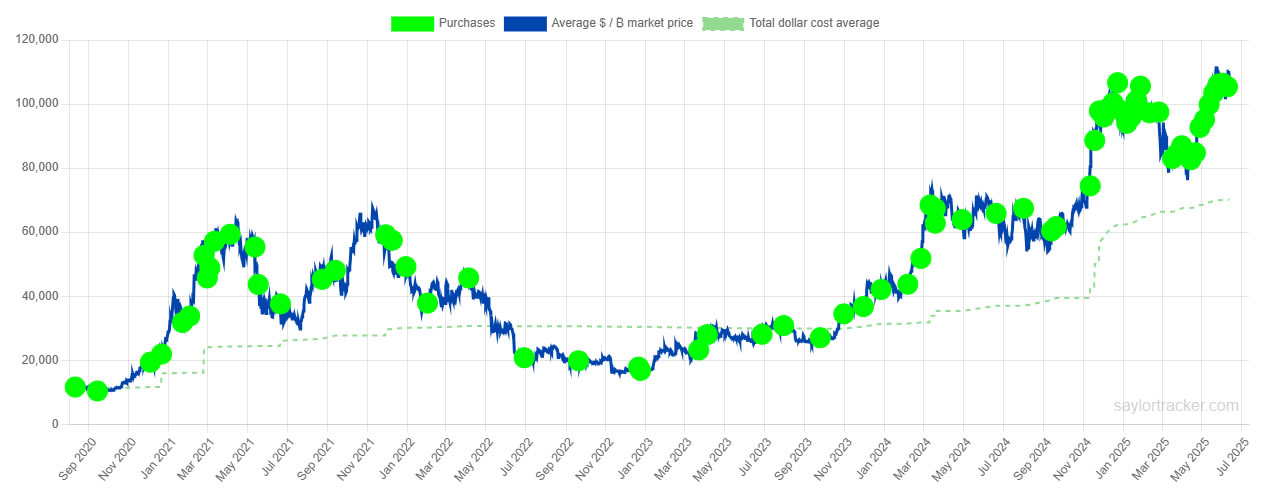

MicroStrategy made its first BTC purchase in August 2020, scooping up 21,454 coins for $250 million at the time.

The company is now the world’s largest corporate holder of the asset with 582,000 BTC worth around $63 billion, according to the Saylor Tracker.

Magazine: Elon Musk Dogecoin pump incoming? SOL tipped to hit $300 in 2025: Trade Secrets

Read the full article here