Retail investors are scrutinizing the crypto market for signs that it may have bottomed out to gauge when to buy more crypto assets, according to crypto sentiment platform Santiment.

“Retail traders are trying to meta-analyze the market, looking for signs of others quitting to time their own entries, which often happens near bottoms,” Santiment said in a report on Saturday.

Santiment has linked this to the word “capitulation,” which has become a top-trending crypto term on social media, according to the platform’s data.

The term describes investors selling their holdings out of fear that the market won’t recover, a scenario that analysts typically monitor when assessing whether the market has reached a bottom.

“Capitulation” may have already happened, says Santiment

“If everyone is waiting for ‘capitulation,’ the bottom might have already happened while they were waiting for a clearer sign,” Santiment said.

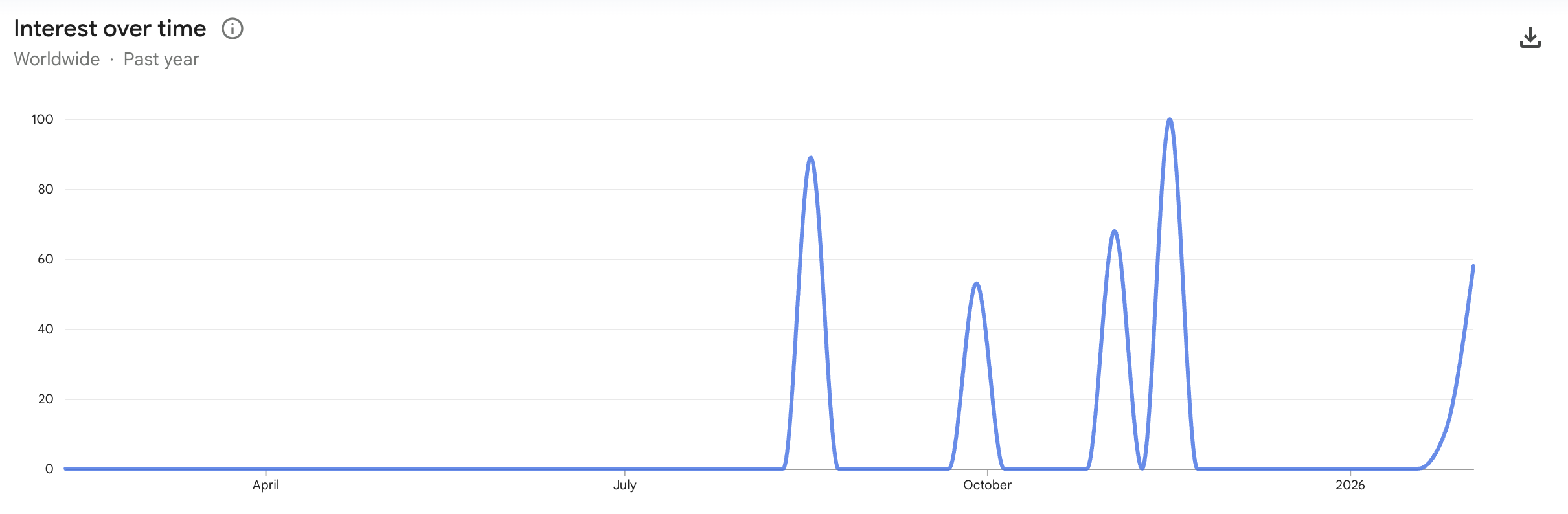

Meanwhile, Google Trends data shows searches for “crypto capitulation” rising from a score of 11 to 58 between the weeks ending Feb. 1 and Feb. 8.

Crypto investors are usually cautious about calling a market bottom too soon. History shows prices can keep falling even when most people think the worst is over.

Market analyst Caleb Franzen said in an X post on Saturday that while capitulation is the “word of the week,” many investors don’t understand that “bear markets typically experience multiple capitulation events.”

It comes as Bitcoin’s (BTC) price dropped as low as $60,000 on Thursday, a level it hasn’t seen since October 2024, amid its ongoing downtrend.

Some analysts are skeptical of the “cycle bottom”

Crypto analyst Ted said in an X post on Friday that “yesterday’s dump looks like capitulation, but it’s not the cycle bottom.”

Echoing a similar sentiment, crypto analyst CryptoGoos said, “We haven’t seen true Bitcoin capitulation so far.”

Related: Over 23% of traders now expect interest rate cut at next FOMC meeting

Over the past 30 days, Bitcoin has fallen 24.27%, trading at $68,970 as of publication, according to CoinMarketCap.

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, fell further into the “Extreme Fear” territory on Sunday, with a score of 7, signaling extreme caution among investors.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Read the full article here