Shares of US crypto companies fell sharply on Friday amid a broader sell-off in risk assets, driven by disappointing economic data and renewed tariff threats.

Shares of Coinbase (COIN), Riot Platforms (RIOT) and CleanSpark (CLSK) dropped between 7% and 16% in Friday trading. The declines mirrored broader market weakness, with the Dow Jones Industrial Average losing over 600 points, the S&P 500 falling 1.6% and the Nasdaq Composite down more than 2% in early trading.

Coinbase’s losses extended a sell-off that began after hours on Thursday, following the company’s disappointing quarterly results. The crypto exchange reported $1.5 billion in revenue for the second quarter, but transaction volumes fell, weighing on results.

While headline net income was $1.4 billion, excluding investment gains, net income was just $33 million.

Riot Platforms also slumped, despite reporting strong Q2 results. The crypto miner more than doubled its revenue to $153 million, including $85.1 million from Bitcoin (BTC) mining. Earnings per share came in at $0.98, far exceeding expectations for a $0.21 loss.

CleanSpark’s decline appeared unrelated to company-specific developments and instead followed the broader market trend. The company last reported earnings in May, showing a 62.5% year-over-year increase in revenue for its fiscal second quarter.

Crypto stocks declined sharply as Bitcoin and the broader digital asset market pulled back. Since these stocks are often viewed as leveraged bets on Bitcoin’s price, their losses were amplified by BTC’s recent pullback.

Bitcoin fell below $115,000 on Friday, down from highs near $120,000 earlier in the week.

Related: Despite record high, S&P 500 is down in Bitcoin terms

Nonfarm payrolls slowdown signals economic weakness

Investors’ appetite for risk assets soured following the latest US nonfarm payrolls report, which showed a sharp slowdown in hiring. The Bureau of Labor Statistics reported just 73,000 jobs created last month, well below the 100,000 gain expected by economists surveyed by Dow Jones.

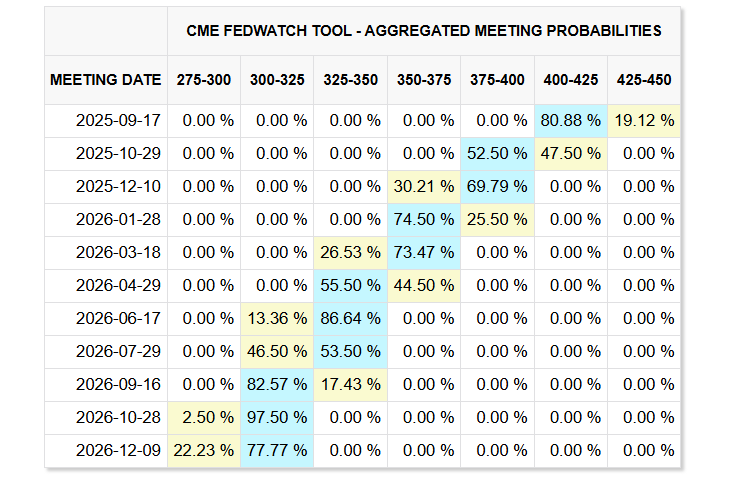

The weaker-than-expected data reignited expectations for more aggressive rate cuts this fall, with CME Group’s FedWatch Tool now pricing in an 80% chance of a September cut.

However, one major obstacle remains: persistent inflation. The Federal Reserve’s preferred inflation gauge — core PCE — came in hotter than expected for June, complicating the case for near-term policy easing.

Meanwhile, US President Donald Trump has reignited trade war concerns after the White House published revised tariff rates ranging from 10% to 41% ahead of the Aug. 1 trade agreement deadline. As part of the changes, the administration imposed 40% tariffs on goods rerouted to bypass existing duties.

“While investors have been viewing the commencement of the Fed cutting cycle as a positive catalyst for risk assets, today’s release is best characterized as ‘bad news is bad news’ in our view,” said Jeffrey Schulze of ClearBridge Investments, referring to the nonfarm payrolls report.

Schulze added that the combination of already weak job growth and rising tariffs could cause the labor market to contract in the coming months.

Magazine: China mocks US crypto policies, Telegram’s new dark markets: Asia Express

Read the full article here