Crypto treasury firms have begun moves to buy over $7.8 billion worth of cryptocurrencies this week, in possibly one of the biggest corporate crypto grabs in recent history — particularly for altcoins.

Cointelegraph analyzed 16 company statements since Monday, which either announced a plan to buy or raise money for crypto. Ether (ETH) was the hottest target.

At least five public companies have bought or have promised to purchase over $3 billion worth of ETH, which is around 45 times more than the amount of ETH issued in the past week.

The so-called crypto treasury companies are the latest Wall Street fad as traditional financiers, often restricted from being able to directly buy crypto or related exchange-traded products, look to gain exposure to the rapidly growing sector.

ETH popularity rises for corporate crypto bet

Bitcoin miner BTCS Inc. on Tuesday filed plans to sell up to $2 billion in shares to fund future purchases of Ether.

Joe Lubin’s Sharplink Gaming, already the second-largest Ethereum treasury firm, boosted the total further by buying up $338 million worth of ETH with two separate buys on Monday and Thursday.

The Ether Machine also scooped up the asset this week, purchasing 15,000 ETH for around $57 million.

Meanwhile, two more Ether buying companies were born this week, with the biotech firm 180 Life Sciences Corp rebranding to ETHZilla Corporation in a $425 million deal and merchant banker Fundamental Global rebranding to FG Nexus in a $200 million deal.

Crypto treasury companies also hot on altcoins

Crypto treasury companies were also dazzled by altcoins this week.

The biggest altcoin-buying announcement came from Tron Inc., a penny stock toy company taken over by Justin Sun’s Tron blockchain, which said on Monday it wants to raise $1 billion to buy the blockchain’s Tron (TRX) token.

Another three companies signalled plans to buy either Solana (SOL), Sui (SUI) or BNB (BNB) — a token with close ties to the crypto exchange Binance.

The most notable treasury firm to form this week was CEA Industries, a Canadian vape company turned BNB buying firm after a takeover by investment firm 10X Capital and YZi Labs. The firm once described itself as the family office of Binance co-founder Changpeng Zhao.

It plans to raise at least $500 million with plans to potentially unlock up to $1.25 billion to buy BNB, which was reportedly owned mainly by Zhao and Binance.

On Thursday, tech company Cemtrex Inc. said it bought $1 million worth of SOL with the goal of expanding to $10 million, while on Monday, the lender Mill City Ventures III completed a $450 million deal to pivot to buying Sui.

Crypto buying firms hold $100 billion, but not without risks

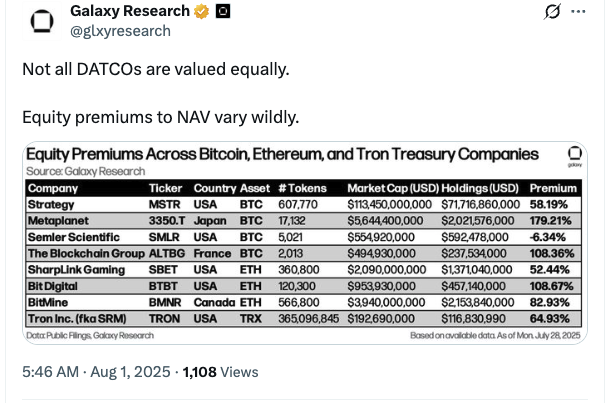

Galaxy Research analyst Will Owens wrote in a report on Wednesday that crypto treasury companies collectively held over $100 billion worth of crypto, $93 billion of which was Bitcoin.

The business model isn’t without its risks, Owens said, and not all are equally valued as investors apply “widely different” equity premiums to a company’s net asset value.

Michael Saylor’s Strategy, for example, had an equity premium of 58%, which Owens said reflected its “scale and maturity,” while Japan’s Metaplanet traded at a premium of 179% due to its “aggressive capital formation model.”

He added that the business model “critically depends on a persistent equity premium to NAV. If the premium collapses, or worse, flips to a discount, the model begins to break.”

“The treasury company trade is becoming increasingly crowded,” Owens said. “When hundreds of firms adopt the same one-directional trade (raise equity, buy crypto, repeat), it can become structurally fragile. A downturn in any of these three variables (investor sentiment, crypto prices, and capital markets liquidity) can start to unravel the rest.”

Strategy helps boost Bitcoin buys

Bitcoin remained a popular choice for crypto treasury firms such as Strategy, with seven companies proposing or buying a total of $2.7 billion in Bitcoin.

Strategy, formerly MicroStrategy, bought 21,021 Bitcoin after raising $2.5 billion from its fourth preferred stock, STRC.

The UK’s The Smarter Web Company also spent about $26.5 million on 225 Bitcoin, and Metaplanet bought 780 Bitcoin for around $92 million.

One new Bitcoin treasury company was spun up through the energy company ZOOZ Power Ltd. on Tuesday, with plans for a $180 million deal to buy Bitcoin.

Magazine: Crypto traders ‘fool themselves’ with price predictions — Peter Brandt

Read the full article here