Rockaa/E+ via Getty Images

Recency bias, or availability bias, is a cognitive error identified in behavioral economics whereby people incorrectly believe that recent events will occur again soon. This tendency is irrational, as it obscures the true or objective probabilities of events occurring, leading people to make poor decisions.” Investopedia

When the “news” came overnight that Credit Suisse was having difficulty, my initial reaction was, “what else is new?” Anyone who is not aware that Credit Suisse was challenged for some time must be sleeping under a rock. Every single Wall Street crisis, bad trade or scandal in the past decade has always included this bank front and center in the middle of the mess. Now they need some capital from their largest investor and the Saudi National Bank has said, “no mas.” So, the Swiss National Bank will step in to provide liquidity and likely backstop the bank in coming days.

For all of the recency bias of people running around talking “counter-party risk” and this is another 2008, think again (or for the first time). The key difference between now and 2008 is that everyone now understands what happened as a result of letting Lehman go. They wanted to punish Dick Fuld for not stepping up to help during the LTCM (Long Term Capital Management) crisis a decade earlier. They shot themselves in the foot. Dick, as far as I know, is doing just fine. As a result of this, we know global central banks will step in quickly and forcefully – as needed – to maintain stability.

If there’s any risk manager that has taken on major counter-party risk with CS, they should be looking for another career. To put it in perspective, CS is now an ~$8B bank. This compares to JPM at $377B, BAC at $227B and GS at $100B. CS is an irritating pimple on the rear end of the global financial system – not a catalyst for another 2008. The Swiss National Bank will prop it up, ring fence it and move on.

As for the regional banking “crisis” in the US (SVB and SBNY), you literally have a situation where management was more focused on providing “safe spaces” and pronouns for their employees than managing risk and protecting their stakeholders.

Unfortunately, the pronouns have now turned into adjectives – “unemployed” and “looking for work” as it relates to employees – and nouns “doughnut hole” and “goose egg” for owners/investors. Don’t get me wrong, I’m all for pronouns and “safe spaces” if the employees want them, but not when the programs are run by the same employee that is supposed to risk manage the portfolio – or in the case of SBNY – the CEO that might have focused more on the business at hand…

There’s plenty of blame to go around as I covered in my media appearances this week. The Fed acted like an insurance company that sells you a homeowners policy, burns your house down and then asks you what you were thinking when they have to pay out… There has been no basic understanding of the lagged effect of maniacal tightening until something broke and now they have to fix it.

As I said months ago, over-tightening could become more inflationary than not tightening enough as the interest costs to service the national debt and the bailout costs to fix things after they break them will far exceed to cost of running inflation above-trend for a few years – as we did the last time we had debt:gdp ~120% (post WWII).

The #1 thing you need to understand is this: If the Bank Term Funding Program (put in place over the weekend) existed last Wednesday, both SVB and SBNY would likely still be in business. They would have been able to borrow against the par value of their (government security) bond portfolios to meet any short term funding needs – versus spooking the capital markets with an equity raise.

Here were my media takes (from most recent backward):

Thanks to Phil Yin and Toufic Gebran for having me on CGTN America on Tuesday night to discuss SVB, SBNY, Inflation, Fed and two new picks:

On Tuesday Morning I went into detail on the chronology of what happened, why it happened, what fixed it, what still needs to be fixed and the opportunities lower bond yields and lower USD will create looking forward. Thanks to Syarifah Dwi Rahma and Fitria Anggrayni for having me on CNBC “Closing Bell” Indonesia:

And finally, on Friday I joined Ann Berry on Public.com to explain the situation as it was unfolding and the implications it would have moving forward. Thanks to Mike Teich for having me on:

Canada has paused hiking rates, Indonesia has paused and so has Malaysia. No bank failures in those countries. Expectations for the Fed have gone from 125bps MORE of hikes just a week ago to between 0-25bps more before pausing. Markets are now also pricing in a cut or more before the end of the year.

After last week’s political pressure from Senator Warren and Congresswoman Pressley, it is becoming more and more apparent that if Chair Powell does not pause soon, he will be among the 2M job losses potentially coming as a result of his aggressive tightening cycle. As I have said for a year, he could have managed this liquidity withdrawal more effectively from unwinding the balance sheet more aggressively as opposed to mindlessly hiking rates until something broke. Well, he finally broke something last week and will now have to clean up his mess. Progress on the balance sheet has been minimal. Complete missed opportunity:

Federalreserve.gov

Powell has an opportunity to salvage himself next week by pausing – or worst case one last hike and a pause (to “save face”). Whenever you live to play defense you wind up with the outcome you most hoped to avoid (he desperately wanted to be Volker instead of Arthur Burns). Arthur Burns may wind up smelling like a rose after the debacle of the 2018 “autopilot” followed up by never-ending bond purchases, followed by mindless unrelenting rate hikes until something broke.

The good news is he can now pause AND save face. Maybe, just maybe, get a “softish” landing if he relents in time – as he did after the Dec 2018 disaster. The data and recent events now give him plenty of cover:

investing.com Investing.com ZeroHegde

St. Louis Fed

You don’t need a magnifying glass to understand which way inflation is headed – and that is BEFORE the impact of yoy lease declines kick-in in coming months.

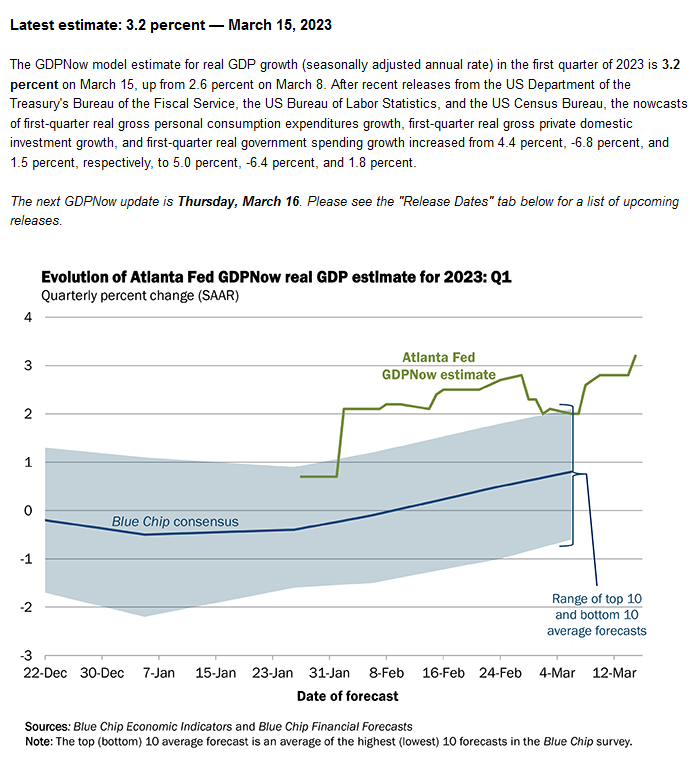

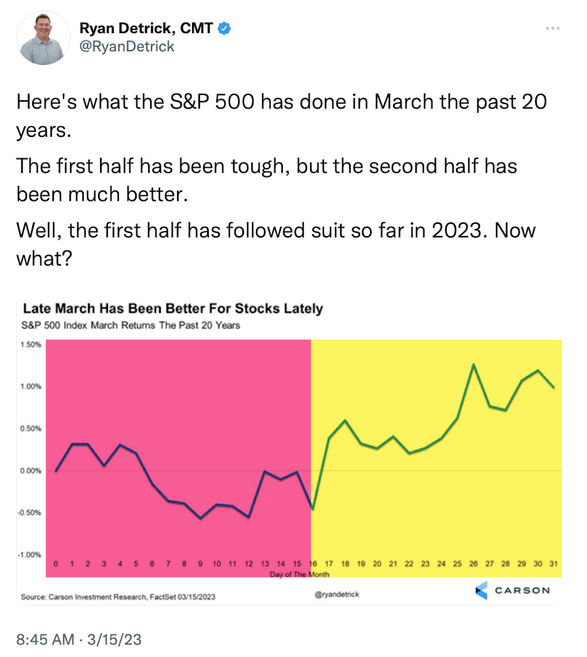

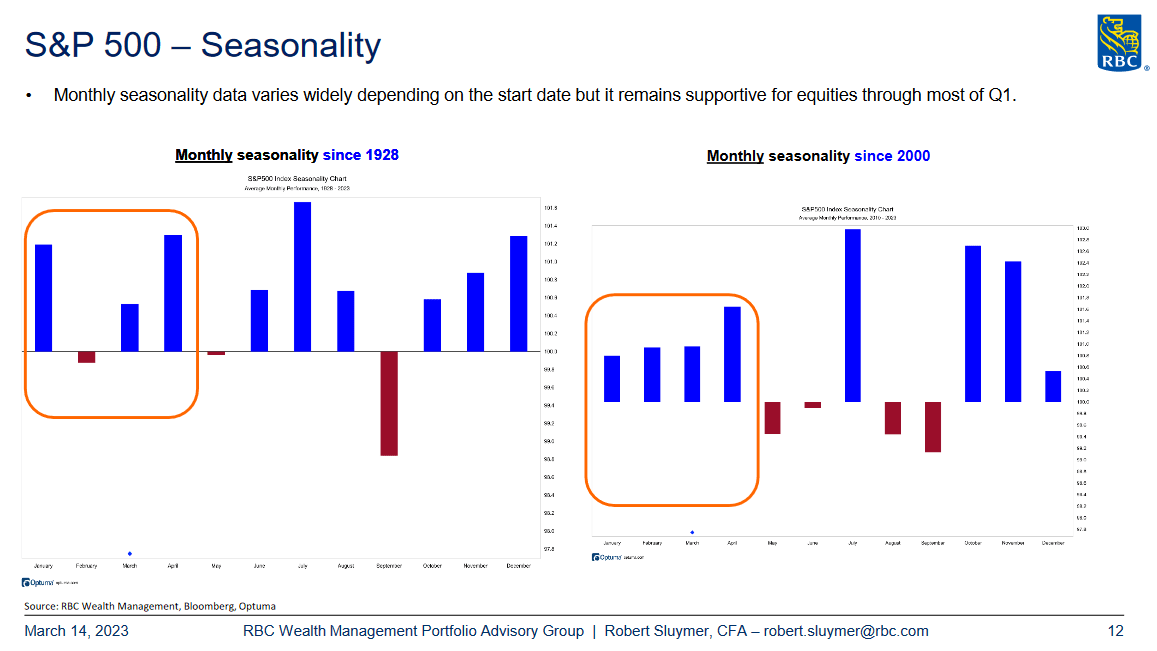

On the plus side, Atlanta GDP now estimates are showing Q1 GDP still above 3%, and earnings estimates have slowly started ticking UP:

Blue Chip Ryan Detrick RBC Wealth Management (Robert Sluymer) Yardeni via Seth Golden

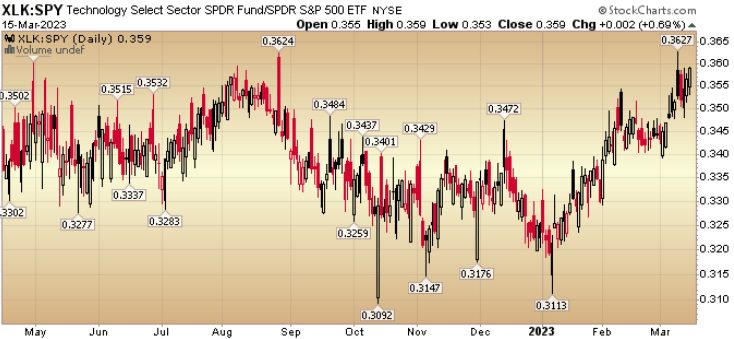

Fidelity Stockcharts.com

Tech continues to outperform YTD.

China Update:

It all comes down to the US Dollar. When the Fed pauses (which will now be much sooner than expected) and the dollar resumes its downtrend, Emerging Markets/China/Alibaba will fly once again:

Stockcharts.com

On our next podcast we will be going through a number of companies’ financials so you can separate what is happening in individual companies versus the daily noise of headlines. There is a ton of opportunity available right now – in our view.

Now onto the shorter term view for the General Market:

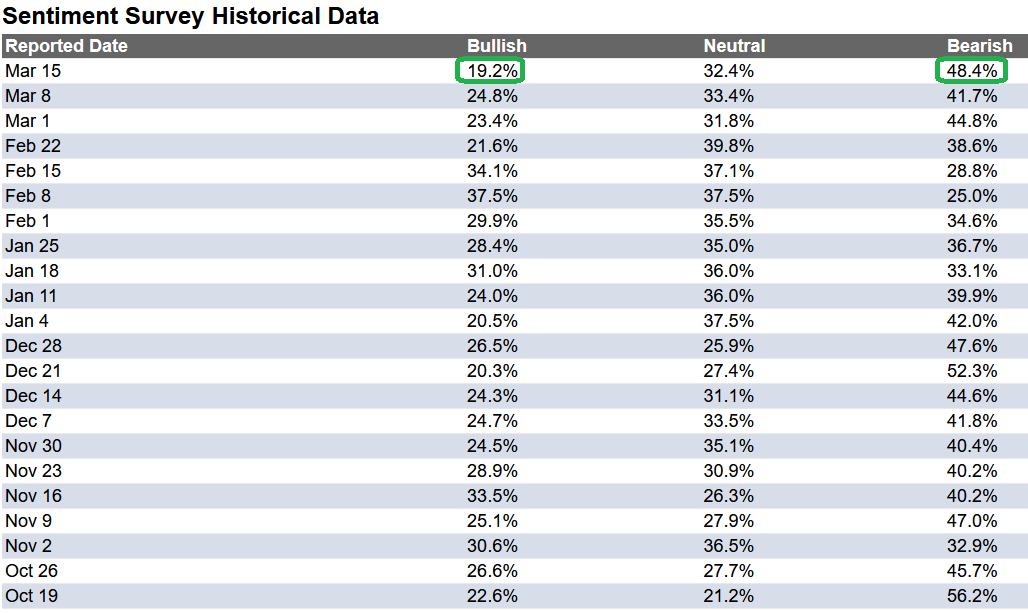

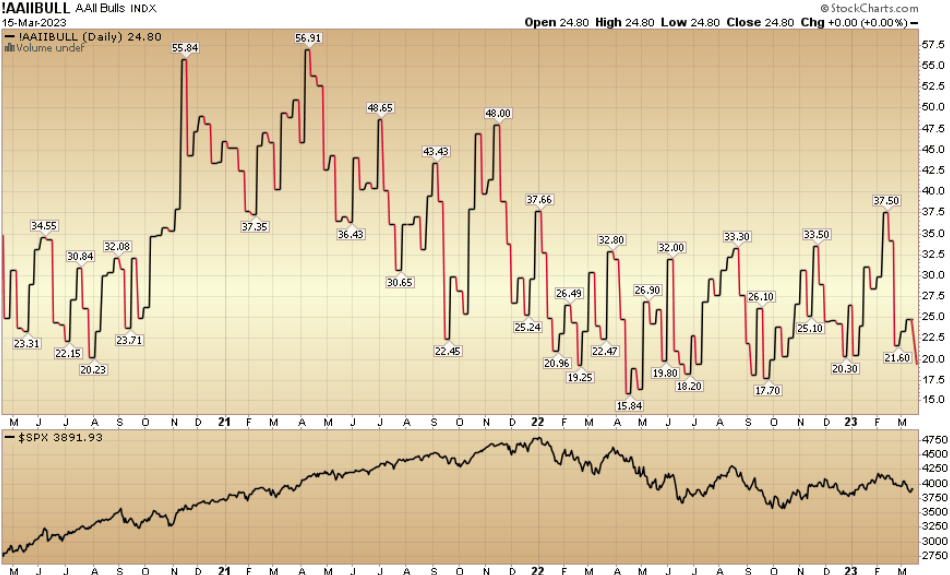

In this week’s AAII Sentiment Survey result, Bullish Percent dropped to 19.2 from 24.8% the previous week. Bearish Percent jumped to 48.4% from 41.7%. Retail traders/investors are shaking in their boots…

AAII Stockcharts.com

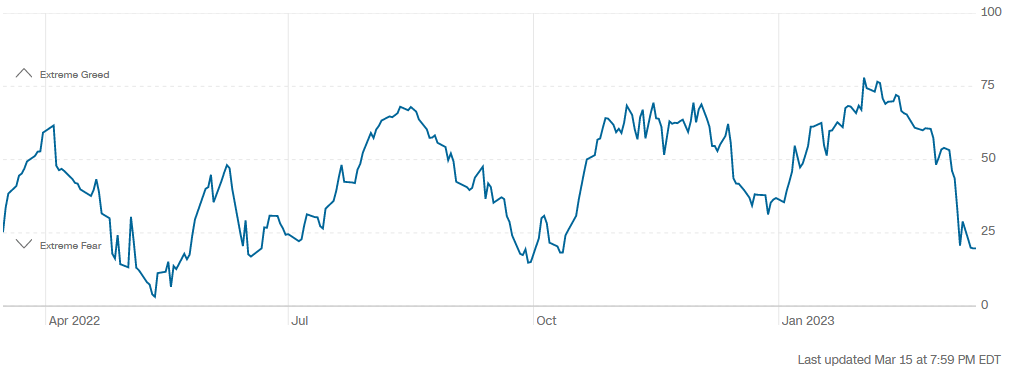

The CNN “Fear and Greed” fell from 46 last week to 20 this week. Sentiment is fearful.

CNN CNN

And finally, the NAAIM (National Association of Active Investment Managers Index) rose to 60.11% this week from 47.41% equity exposure last week.

Stockcharts.com

*Opinion, not advice. See “terms” at hedgefundtips.com.

Read the full article here