Key takeaways:

-

ETH rallied 41% in a month, but derivatives data shows traders remaining cautious, not bullish.

-

Institutional inflows and corporate Ether reserves suggest strong demand, yet recession risks cloud the outlook.

Ether (ETH) climbed to $4,349 on Monday, its highest price since December 2021. Despite outperforming the broader cryptocurrency market by more than 30% over the past 30 days, derivatives data shows ETH traders have yet to turn decisively bullish.

This has raised doubts about whether a rally to $5,000 is likely in the near term.

ETH has gained 41% in the past month, compared to a 9% increase in total crypto market capitalization. With such strong outperformance, demand for hedging naturally rises as traders lock in profits and rotate into other opportunities. The lack of appetite for leveraged bullish bets above $4,000 is therefore not unexpected.

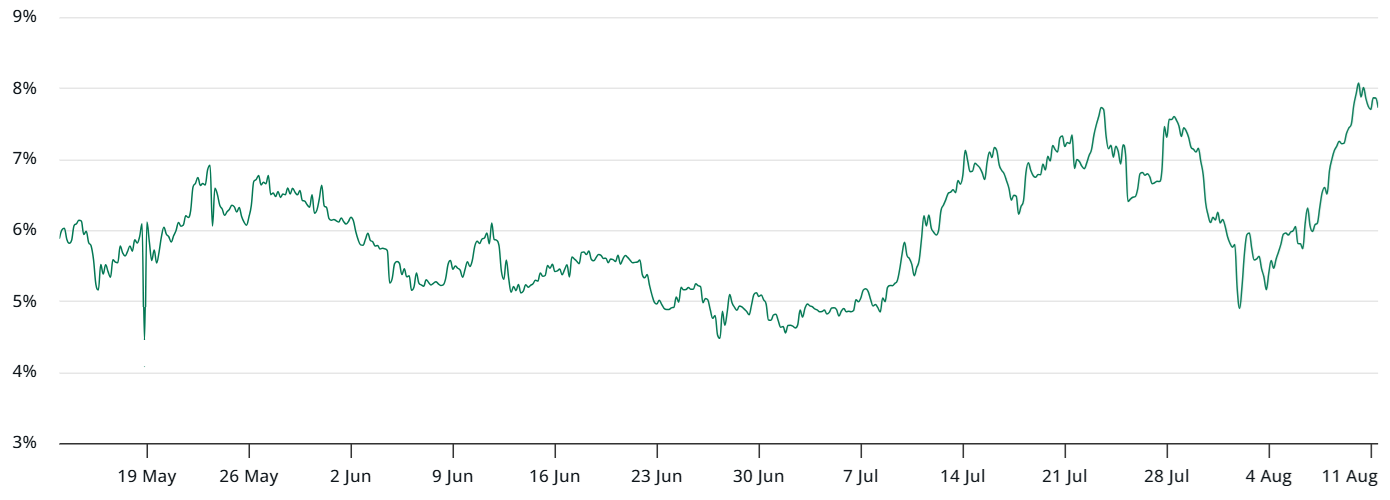

In neutral market conditions, monthly futures contracts typically trade at a 5% to 10% premium relative to spot markets to offset the longer settlement period. Yet despite ETH nearing six-month highs, this premium remains below a clear bullish threshold.

The lack of bullishness is somewhat concerning given that spot Ether exchange-traded funds attracted $683 million in net inflows between Thursday and Friday.

ETH options reflect neutral conditions despite rally

The ETH options market provides clues to gauge whether traders missed the rally and are waiting for a better entry or instead expect a price drop below $4,000.

In bearish setups, the options delta skew moves above the 6% neutral mark as put (sell) contracts command higher premiums. Conversely, excessive bullishness will drive the indicator below -6%.

Currently at -3%, the ETH options delta skew points to neutral sentiment. The metric has improved significantly since Aug. 2, when it briefly turned bearish after a 13% price drop.

Related: Ethereum’s Fusaka upgrade set for November – What you need to know

In short, professional traders are not aggressively bullish but are not expecting ETH to retest $4,000 either. Stronger institutional demand for ETH holdings helps explain this sentiment shift.

Publicly traded BitMine Immersion (BMNR) said Monday it added 317,126 ETH to its corporate reserves, valued at $1.35 billion at current prices. Meanwhile, Sharplink Gaming (SBET) disclosed it raised nearly $900 million to expand its ETH reserve strategy.

The company already holds about 600,000 ETH on its balance sheet, worth over $2.55 billion at today’s levels.

Economic recession risk is the biggest threat to $5,000 ETH

Ether’s neutral derivatives readings appear encouraging, especially given that traders failed to anticipate the swift rally from $3,400 to $4,300 in just eight days.

The longer ETH price stays above $4,000, the greater the likelihood that traders will gain confidence and initiate bullish positions, which could pave the way for a move toward $5,000.

Macroeconomic conditions and overall risk appetite remain the main obstacles to further gains. Some investors worry that US import tariffs could weigh on global economic growth. However, the expected summit between Russian President Vladimir Putin and US President Donald Trump has eased geopolitical tensions, at least for now.

If spot ETF inflows continue and companies keep raising capital to expand Ether reserves, ETH is well-positioned to outperform the broader cryptocurrency market.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Read the full article here