Solskin

Dear readers/subscribers,

It’s been a relatively calm sort of 2023 for me in terms of pharma/healthcare. I haven’t done any massive new investments in the sector, and even gone ahead and trimmed/harvested some profit at select periods in time. My current exposure to the sector is significantly lower than it was in 2021. I don’t view the sector as unattractive, but I view other sectors as generally more attractive than I do pharma/healthcare.

With that said, undervaluation opportunities exist in every sector – and Evotec (NASDAQ:EVO) might be one of them. In this article, I’ll look at what the company can offer us if we were to invest in it.

This marks the initial thesis for my work and stance on EVO stock.

Evotec SE – Appealing or not?

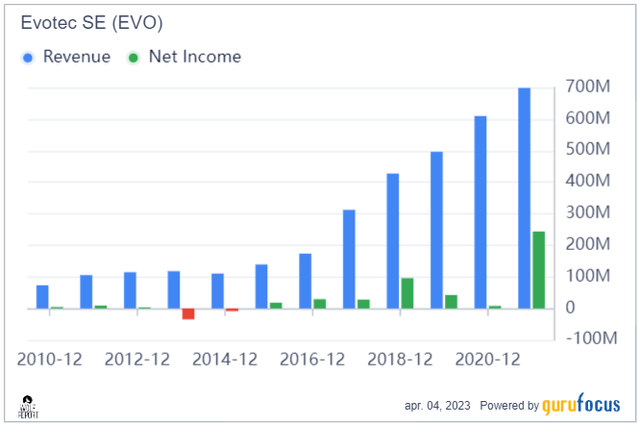

Evotec is a publicly listed drug discovery and development company. Its revenues of around €700M for the 2022 period means that it’s a relatively small business in terms of market cap. It lacks any dividend and was relatively recently listed on the Nasdaq, a listing which raised the company around half a billion dollars in capital.

Drug discovery is a very complex area and involves very high risk. Unlike investing in market-leading portfolio companies like Bristol Myers (BMY), you’re betting on the company’s ability to execute strictly in the discovery cycle – going from the screening of small molecules, extracts, or natural products to identifying substances with desirable therapeutic effects, and through processes like reverse pharmacology and the like discover new potentials and candidates for clinical trials. The trials are some of the last steps in a drug discovery company. Given the number of resources, people, and expertise involved, it’s no secret that this is a very capital-intensive process, and the rate of discovery or success is low. Back in 2010, which is now over 13 years ago, the cost of discovery of each new molecular entity, or NCE, was on average $1.8B.

Success in this field can mean three-figure to six-figure returns, depending on how successful the company is. But it is nonetheless a risky process.

Evotec is a player in that process.

The company has several advantages.

First off, it was founded in 1993 by founders that included a Nobel Laureate in chemistry. The company’s over-time success has enabled it to grow inorganically, M&As which included DeveloGen, Kinaxo, CGS Cell Culture, Euprotec, Cyprotex, Aptuit, and others. It also has very close relationships with French giant Sanofi (SNY). In 2015, the company took over the small molecule development center in Toulouse, which came with several hundred chemists, and 4 years ago, it acquired the Sanofi Infectious Disease unit.

Evotec IR (Evotec IR)

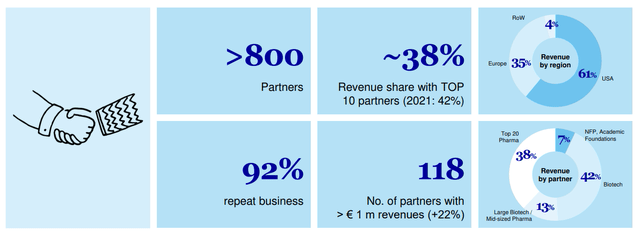

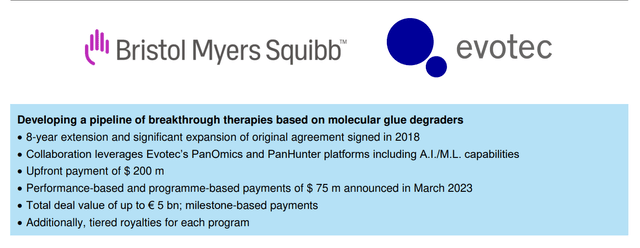

Despite a comparatively small set of revenues, the company is a relatively major player on the market, with partnerships with some of the largest companies on earth in the field, including Bristol Myers Squibb. The company has multiple ongoing strategic partnerships, and good contacts with the EIB, the European investment bank, for its development loans, which recently granted a €150M unsecured facility.

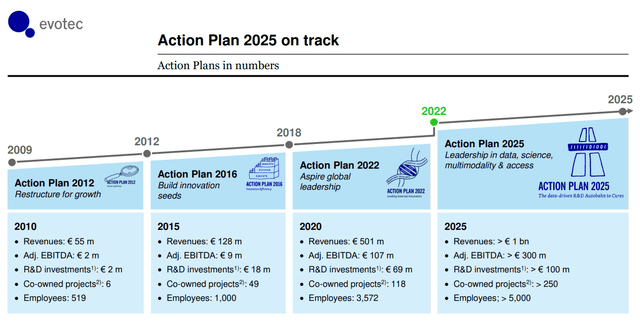

Since the company’s restructuring in 2010 when the company was at less than €100M in revenues, Evotec has been a very impressive grower.

Evotec IR (Evotec IR)

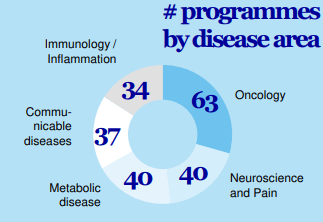

Its strategy involves the building of a long-term royalty pool that effectively offsets any massive expenses on the R&D side. The company already owns or co-owns 130 pipeline assets, 18 of which are in their clinical stage, and with another €15B in potential partnership milestones. Evotec takes an 8-10% royalty rate for its assets, and it’s in a wide range of treatment areas.

Evotec IR (Evotec IR)

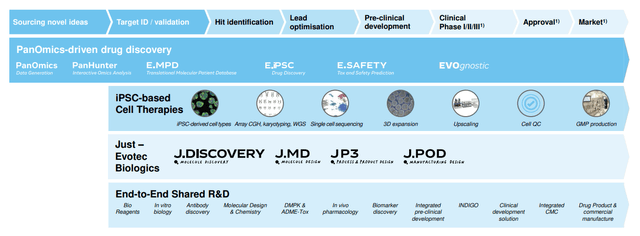

The company’s four focus areas include PanOmics (disease understanding), iPSC-based Cell therapies, Evotec Biologics, and End-to-End shared R&D, all with a focus on developing superior medicines.

Evotec IR (Evotec IR)

The company is already working with world-leading partners in PanOmics, including Bayer (OTCPK:BAYRY), Novo Nordisk (NVO), BMY, Boehringer Ingelheim, Eli Lilly (LLY), and others. Over 20 collaborations and 50 programs ensure the company’s appeal here. Its partnership with BMY is one of the most significant in the entire industry.

Evotec IR (Evotec IR)

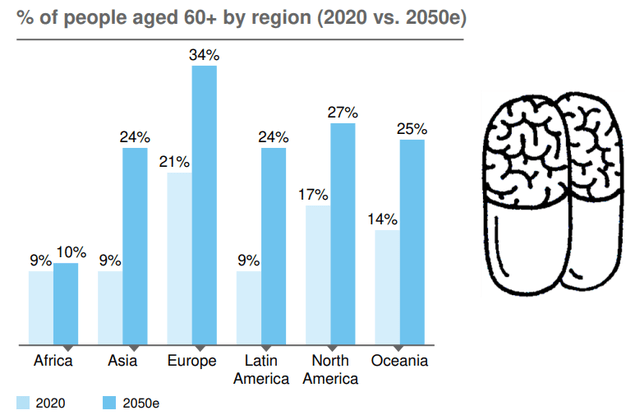

Overall, the macro and demographic development is in favor of companies like Evotec. Aging is driving up the incidence rates of neurodegenerative diseases, and the current understanding of underlying mechanisms is very limited. This is a global $50B+ market as expected by the end of 2030, and Evotec is a primary company to be in the “middle” of it.

Evotec IR (Evotec IR)

Evotec is a company in high demand, evidenced by the number of partnerships and sales volume, with an order book that’s already tripled in 2022 compared to 2021. Evotec is, without a doubt, doing many things correctly. Its R&D is 18% faster than the overall average market, and its shared R&D business mix is attractive.

Financially speaking, Evotec works with a gross margin of above 23%, or 31% if we exclude Evotec Biologics which are currently fairly dilutive towards margins. The company’s gross margins on a company-wide basis are among the worst in the Drug Manufacturers comp group, putting the company at the 14th percentile. These relatively poor competitive rankings are found across the entire return chain, in RoE, ROA, ROIC, and in net margins. Not only is the company at the 25-35th percentile here, but the company is also in a significantly worse return trend than it has historically been. Some of this can be explained with a very simple fact – the company is growing.

When looking at the revenue growth rate, Evotec is among the fastest grower in the entire industry. Its 3 year-average puts it in the 91st percentile, and its fundamental ratios such as cash and quick are still very solid. Revenues and net incomes are also positive, and the company is very cash-heavy following the proceeds of the Nasdaq listing as well as a few other moves Evotec has made.

Evotec Revenue/Income (GuruFocus)

The fact that Evotec does not pay a dividend is a bit of a problem – and this issue extends to valuing the company at anything close to what I would consider being a standard valuation model.

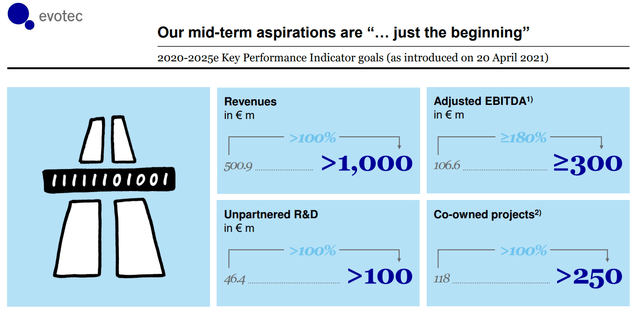

For the time being, it’s clear to me that Evotec is growing, and there is plenty of potential in the company’s pipeline. Its historical success rate speaks in favor of Evotec, but history certainly isn’t everything. As the company grows, the risk that a single failure would fundamentally de-rail the company’s business becomes smaller and smaller. The company has a solid balance sheet, with a net cash position and over €715 in liquidity, with an operating cash flow of €203 from a total balance sheet position of just over €2.25B. The goals for Fiscal 2023 are ambitious, but not impossible for the company to reach.

Evotec IR (Evotec IR)

With that said, Evotec is in some ways a leading company in this sector – growth is very good, and is expected to continue to be positive in this context for the company.

This brings us to perhaps the most difficult segment of this article – the company valuation.

Evotec – The valuation

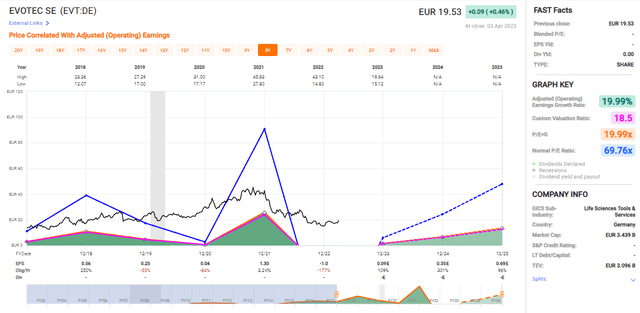

So, the reason why evaluating the company is rather complex is related to the company’s volatility in terms of GAAP and earnings. Net income is more stable than you might think – mostly positive, and cash is growing, but earnings and forecasting are rough. Take a look at the company’s overall historical performance.

Evotec Valuation (F.A.S.T Graphs)

So, rough. P/E doesn’t really work as such. The company does have analysts following the native ticker, EVT – 10 of them. They come to a price target range of €20 on the low side to about €50/share on the high side, with an average of around €26.93. based on a current share price of around €19.5, this means that there is a calculated upside of around 38% at his time. High, to be sure. We’re looking at rev multiples of about 3.9x, and sales of about 4.3x, and those are mostly the ones we look at. EBIT, EBITDA, and EPS multiples make little sense in this context, and DCF calculations don’t really work either.

Comps differ depending on what you look at. Some put EVT in the Life Science/Tech sector, which puts it alongside businesses like Lonza Group (OTCPK:LZAGY), Samsung Biologics, Eurofins Scientific (OTCPK:ERFSF), Syneos Health (SYNH), and others. But it can also be compared to generic drug manufacturers, which would include companies like Merck KGaA (OTCPK:MKGAF), Zoetis (ZTS), Takeda (TAK), Haleon (HLN), and others. Compared to most of these, Evotec is still a small fish in a big pond, especially compared to Merck and Zoetis, which together have more than 40x the market cap of Evotec. This does not make the company bad, I’m just highlighting what else might be available to you.

Why am I doing this?

Because capital invested in one company cannot be invested in another. If you invest $10,000 in Evotec, that $10,000 isn’t going into Merck or Zoetis – or any other investment you might consider.

Most investors take capital allocation far too lightly. It’s not enough to consider that a company is attractive. I’ll be clear in saying Evotec is attractive. It also needs to be attractive in context to what else is available.

And the fact is, we’re talking about investing in a company that, in context, is small. it doesn’t have sector-leading margins. I see growth forecasts, but analysts fail their target more than 40% of the time – 100% if you include positive “failures” of forecasts. The implication is clear as crystal. Evotec is incredibly hard to forecast.

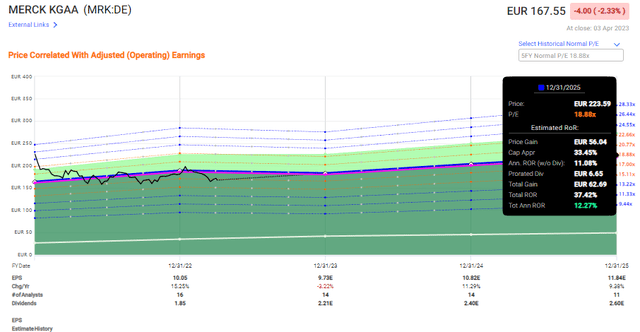

If you have a spine of steel, time to wait, and don’t need a dividend, then Evotec could be for you. But the simple fact is, Merck KGaA is available at essentially fair value. Not only is this company a market leader in market cap, but it’s also leading in most return indicators/margins. It’s also not shabby in terms of growth and comes with a 1.1% yield, which is better than the 0% we see in Evotec.

Merck KGaA upside (F.A.S.T graphs)

My point isn’t that there isn’t appeal in Evotec – only to consider carefully where you place your capital. Despite a high appeal in the company based on what “might” happen, I don’t consider the safety or predictability, or return implications for this company to be high enough that I would be willing to put my hard-earned money to work in this business. I own Merck – I do not own Evotec.

And for now, that’s the way it’s going to stay. I want more predictability. This is especially true in a market where I can do the equivalent of throwing a rock and “hitting” an undervalued, BBB, or higher-rated company with a good yield and good upside to “BUY”.

Evotec might have appealed in a market that had little undervalued growth coupled with yield – but that is not the market we’re in today.

I’m going to call Evotec a “BUY” – a speculative one – but it comes with a few caveats.

Thesis

- Evotec is an attractive company in the medical/drug discovery field. It has an attractive pipeline, decent fundamentals, and a growth rate not matched by many companies in either the sector or the market, having grown from less than €100M to potentially over €1B in this coming fiscal in terms of revenues.

- However, plays like this are risky – and my risk tolerance at this time is limited. I view it best to err on the side of safety and pick history and quality in these sectors, with predictability. For now, that is not Evotec.

- The company is a theoretically attractive speculative “BUY” with a price target of €25/share for the native – but that is as high as I am currently willing to go.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Three out of five is not good enough for a conservative investment ,but it’s good enough for a “spec buy” here.

Read the full article here