The House is scheduled to vote Wednesday on a big budget resolution, the first step in a process that would allow Republicans to cut taxes and reshape federal spending for the next decade.

House members already voted on a budget in February. But the new version, written in the Senate, involves major changes. It would increase the federal debt by a lot more: as much as $6.9 trillion over a decade, instead of the $3.8 trillion projected in February. It is spare on policy details. If it passes, Congress will then need to write specific legislation that follows its basic instructions.

Its passage is not guaranteed. Many House Republicans who are concerned about debt and deficits have said they oppose the new version.

Here’s what’s in the budget — and how it differs from the previous version.

Extending the 2017 tax cuts

Both budgets would extend parts of the 2017 Trump tax cuts. But the new version would allow lawmakers to make the cuts lasting, while the earlier version would require them to expire again in 10 years. That means that, while their costs are the same initially, the new version could increase federal deficits and debts by much more after 2034.

To make lasting tax cuts possible, the new budget uses an unconventional accounting maneuver known as the “current policy baseline,” which assumes the 2017 tax cuts don’t expire after this year even though the law that created them says they will. It’s still unclear whether the move complies with the Senate’s special rules for budget legislation, but lawmakers decided to use the baseline without consulting the Senate rules expert in advance.

Additional tax cuts allowed

Both budgets would allow Congress to make additional tax cuts. The new version would allow for larger cuts and increase the chances that Congress would adopt expensive tax policies favored by President Trump, like the elimination of taxes on tips.

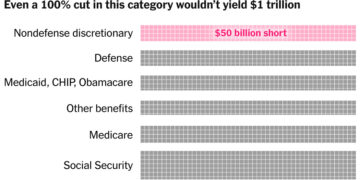

The old version of the budget required extensive spending cuts, up to $2 trillion, with a large share assigned to the House committee that oversees the Medicaid program. The new budget requires far less on paper, though congressional leaders say they still intend to pass substantial spending cuts as part of their final legislation. The new version makes it much harder to know how big they will be or what programs will be cut. Some Republican senators have expressed concern about the effects of big Medicaid cuts on their states, and the more flexible targets could make it easier to avoid major cuts without upending the entire bill.

Spending increases allowed

The old budget called for increased spending on defense and border security. The new budget would allow larger increases.

Potential effect on the debt

The new version, as written, could add nearly $7 trillion to the debt over the next 10 years including interest, and more in years after. That high number reflects the uncertainty of the spending cuts. Lawmakers will probably choose to cut spending by more than $4 billion over the decade, but we don’t yet know by how much.

There is one major sign that lawmakers expect to increase the deficit more with this version: It would raise the debt ceiling by a larger amount than the February version. The debt ceiling limits how much money the federal government is allowed to borrow.

Congress wants to pass a major package of policy changes, which President Trump sometimes calls the “one big, beautiful bill,” using a special reconciliation process that could pass without any Democratic votes in the Senate. The budget lays out the required targets for that process.

If this budget doesn’t pass, Congress won’t be able to easily extend the tax cuts, cut federal spending or make any of the other big policy changes Republicans hope to enact.

Read the full article here