SDI Productions/E+ via Getty Images

Dear readers/followers,

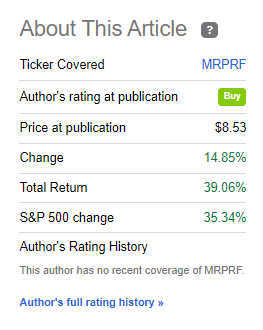

The time has come for me to update my thesis on Merlin Properties (OTCPK:MRPRF). The company is a REIT found in Spain – it’s one of my few Spanish, natively-listed investments, and one I’ve held for quite some time at this point. It’s a good example of why I don’t sell what I view as attractively-priced quality.

In this article, I’m revisiting the thesis for Merlin, and showing you why the company, even after generating a total outperformance of close to 40%, is still a potential “BUY” Here.

Seeking Alpha Merlin Article (Seeking Alpha)

The updated Thesis on Merlin Properties for 2023 – Good value

Merlin isn’t an old company/REIT – it has a history going back barely 9 years, and the founding involves former executives from the European banking sector, namely Deutsche Bank, going and founding a REIT with the financial backing of BlackRock (BLK). That should be some vote of confidence going into this update.

The company’s initial assets consisted of 1,000 office properties from one of the largest banks in Spain, as well as the real estate division from construction company Sacyr, and the M&A of Metrovaceas S.A. This was then known as “merlin”.

Since that time, Merlin has increased quality and expanded its operations. It got IG as early as 2 years after its founding, once again showcasing quality (especially in the REIT space, of all places).

Today, the company owns a mix of office spaces, logistical centers, shopping malls/centers, and “other”. All of the properties have an average occupancy of over 90%. Shopping centers are over 94%, logistics are over 99% and others are over 97%. That brings the company-wide average to over 95% occupancy, with an average lease of 3.2 years – relatively low, but still.

The company’s properties are found in Madrid, Barcelona, Lisbon, and some small amounts in other cities/locations. It can be said, however, that Merlin is mostly exposed to these cities.

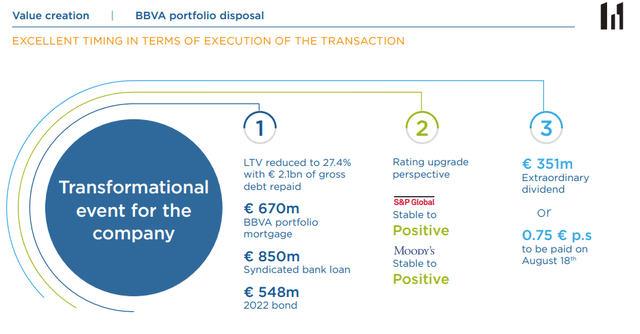

Merlin also has one of the lowest funding costs you’ll see in most REITs. The company’s fixed-rate debt is at 99.6% of the total, and the average cost of that debt is 1.94%. The LTV is below 30, at 27.4%, with a net debt of €3.2B and liquidity of €1.77B.

Those are some great numbers – that LTV might be somewhat propped up by a positive – until now – property sector, but even impaired, that’s low leverage for a company like this.

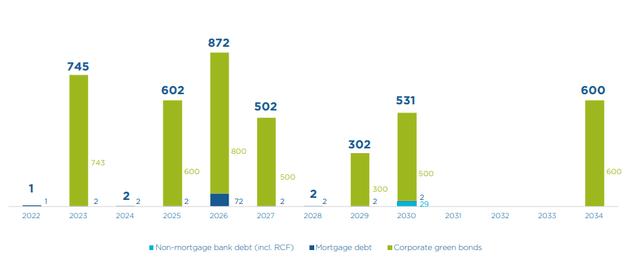

Company Maturities are excellent as of now.

Merlin IR (Merlin IR)

The fact is that the company has been very proactive and with good timing to reduce that exposure. This was done just in time to many of the changes we’re seeing in the market today.

Merlin IR (Merlin IR)

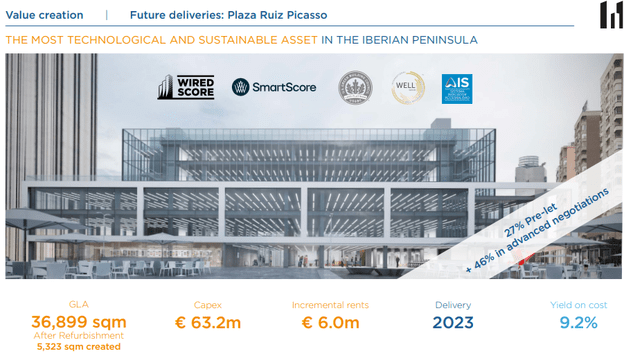

Merlin, like other successful REITs, is an active disposer of non-core assets, and the company is capable of doing this at a premium to the GAV, with an average of 8.9% for the latest set of 4 office buildings. The company then acquires/operates some of the most advanced buildings in the area where they operate – the Iberian peninsula. Plaza Ruiz Picasso is a very good example of this.

Merlin IR (Merlin IR)

The company was initially primarily a net-lease REIT, with 70% net lease property found in the company portfolio in 2014. However, over the course of 4-5 years, Offices and Logistics quickly grew to eclipse its net lease exposure, to where it stands at far lower.

Over the past few years, the company has focused on gaining not only Spain but also Portugal exposure, which it considers a key market, and it has certain absolute gems in its portfolio, which include The Nestlé Headquarters, Almada, Lisbon Park, Lisboa Expo and the TFM Building – and this is a development that’s been moving forward for the past couple of years as well with the company’s acquiring and divesting.

The company is also currently executing an advanced Digital Infrastructure plan, with several assets coming online. Most of these are already pre-let at over 50%, with advanced negotiations bringing the pre-let percentage up to 66% for one. Several of these projects are not even in construction starts yet, but already demand for the company’s assets here is sky-high.

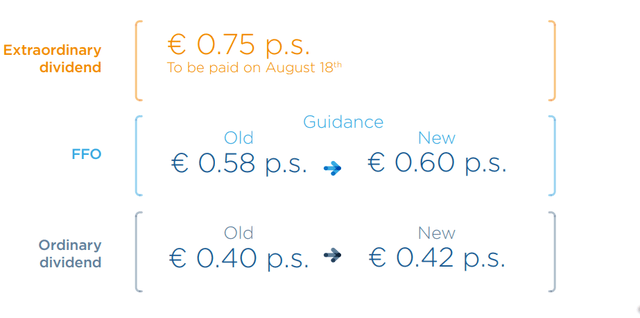

Merlin typically reports on a half-year basis. So for the last 6-month period in 2022, we have 2022E forecasts. The company paid a significant extraordinary dividend back in august, together with an increase in the ordinary dividend based on an increase in FFO.

Merlin IR (Merlin IR)

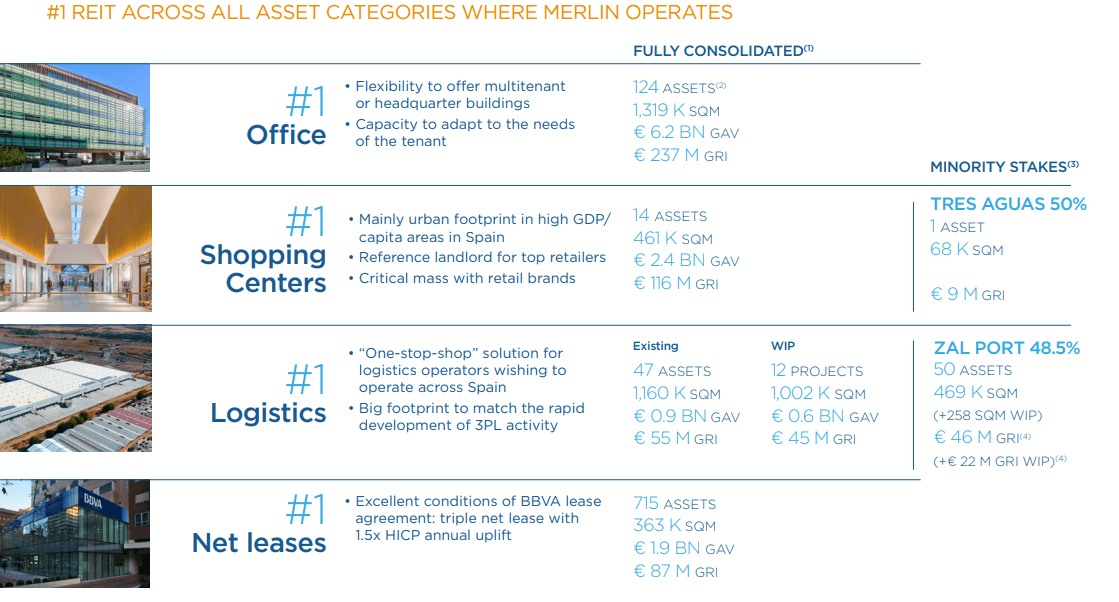

Merlin is an absolute market leader in some segments. In fact, when we turn to look at exactly how the company is positioned, namely in Spain and Portugal, Merlin is on a solid #1 in all asset categories.

Merlin IR (Merlin IR)

Of course, it’s easy to be a market leader in such geography, where the REIT market is a very small market compared to say, the USA. But still, it bears mentioning. The reason is that management for this company knows, I believe exactly what they are doing. They’re run by extremely knowledgeable and capable individuals with decades of experience, and they’ve found a perfect “weakness” in the market and something to build upon.

Despite a whole host of operational risks and challenges, as well as macro challenges, Merlin has delivered annual and half-year strong performance across every single metric. What do I mean by every single metric?

When evaluating a REIT, I look at:

- Occupancy

- LfL rental growth/FFO growth

- release spreads

- Divestment/M&A’s

- Dividend growth

- Credit rating/debt/maturities

Merlin does everything right here. Occupancy is actually increasing across all asset classes, despite the issues, and the inflation is favoring the financials of the company, with a 56% portion of the rents revised upward at an average uplift of 5.4%, which comes to €13M annually of additional rent payments, and resulted in an increase in FFO guidance.

As a result of the company’s solid performance, the upside we once saw in Merlin is no longer there. We’ll look at here though why the REIT is still a “BUY” and why I’m keeping my position and potentially adding more as well.

Let’s look at the company’s valuation.

Updating on Merlin’s valuation – still cheap, most agree it’s a “BUY” here.

When I last comprehensively covered Merlin, we were in the midst of a massive crash in valuation. The company traded 30% and more at the level we see here.

This made it very easy to see a conservative upside, due to the degree of asset undervaluation we saw. That isn’t as easy to see today. Last we looked at Merlin, we had a 0.45x to its EPRA NAV – that is now up to around 0.7x. While this NAV multiple is not yet at its mean, which lies around 0.85x weighed since the company’s public listing, its getting back up there. I would call it a stretch based on EPRA NAV multiples and similar metrics, to call the company “cheap” at this point.

I no longer see Merlin as “cheap”.

Nor is the yield something to write home about, next to some of the peers in the REIT space. At this time and outside of extraordinary dividends, it’s no higher than just south of 4%. REITs with office space typically command a higher dividend yield.

However, when we look at overall analysts, we find that most analysts do consider this REIT to still be at least somewhat undervalued. 17 analysts follow Merlin – out of those 12 are still at “BUY” or “Outperform” at the current price of €9.1/share. The average weighted PT for the company here is €10.7/share, and I would go even somewhat higher than this level, to just about €11/share. The range these analysts see is a low of around €7.9 and a high of €13.5, so we can see €11 as close to a midpoint in that valuation.

This gives us an upside of at least 15% to a conservative PT at this particular time. We need to consider how Merlin typically trades because it’s typically a very highly-valued REIT, due in no small part to the perceived value of its properties and its plans going forward.

COVID-19 did break this in a spectacular manner, which saw Merlin trade down to below €7, where I bought more. But this break in valuation was not backed up by post-coronavirus effects. Since COVID-19 is over, the company has seen a near-unbroken stream of increases in funds from operations and earnings, which has left Merlin in a very good position of moving forward.

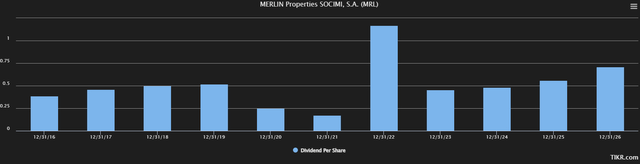

The extraordinary dividend being one thing, the company is expected to significantly pick up its dividend payouts again, to where we are beyond normalization in 2025E.

Merlin dividend (TIKR.com)

And with the extraordinary dividend last year calculated into the last 2 years, shareholders have been more than made whole in terms of remuneration.

So, for that reason, I’m at the following place with my Merlin thesis at this particular time.

Thesis

- Knowing Spain fairly well as a market, and also knowing Portugal/Lisbon, however, I find the company a very appealing prospect at this time, even after close on 3 years. Merlin is attractive for its assets and for the way it manages and grows those assets while disposing of non-core and unattractive ones. The company isn’t the highest yielder, but it’s safe and I view it as a company with a double-digit upside here.

- My PT for the REIT is around €11/share as of this update, and I believe you should take a look at the company to see if you’re ripe for some European exposure in your “REIT work”. I personally have 0.4% in Merlin of my portfolio, and that’s with the growth we’ve been seeing. I have no plans to trim or dispose of this position but to increase it further.

- I view Merlin as a “BUY” here, and I believe the company is set to grow more.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The only issue with Merlin is that the company can’t really be called “cheap” here. Aside from that, I’m on board and buying more.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here