The S&P 500 approached its February all-time high yesterday — but is there any fuel left for the bulls?

The stock market extended its gains on Thursday, with the S&P 500 closing 0.80% higher and coming within reach of its February 19 record high of 6,147.43. Investor sentiment remained bullish, supported by the de-escalation of Middle East tensions and optimism surrounding potential new tariff-related agreements.

This morning, the S&P 500 is expected to open 0.3% higher, potentially breaking into new all-time high territory.

Investor sentiment has slightly improved, as reflected in the Wednesday’s AAII Investor Sentiment Survey, which reported that 35.1% of individual investors are bullish, while 40.3% are bearish.

The S&P 500 continues its uptrend, as the daily chart indicates.

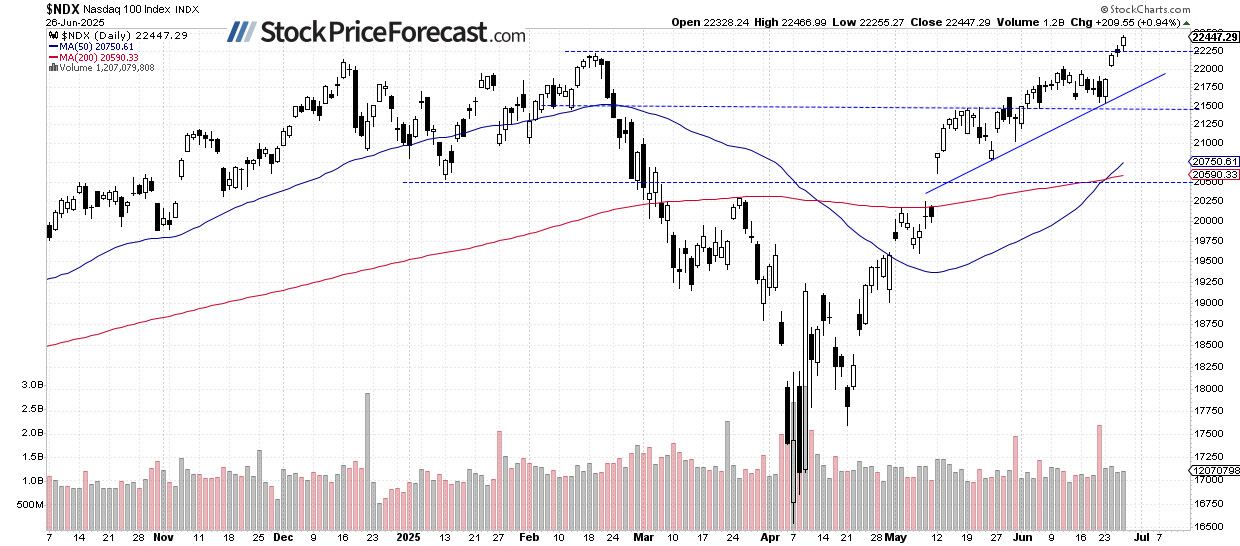

Nasdaq 100 hits new records

The Nasdaq 100 led Thursday’s gains, rising 0.94% to a new record high of 22,466.99. Key support is now around the 22,220 level. While no immediate technical sell signals are evident, the index may be entering overbought territory, suggesting the potential for short-term consolidation.

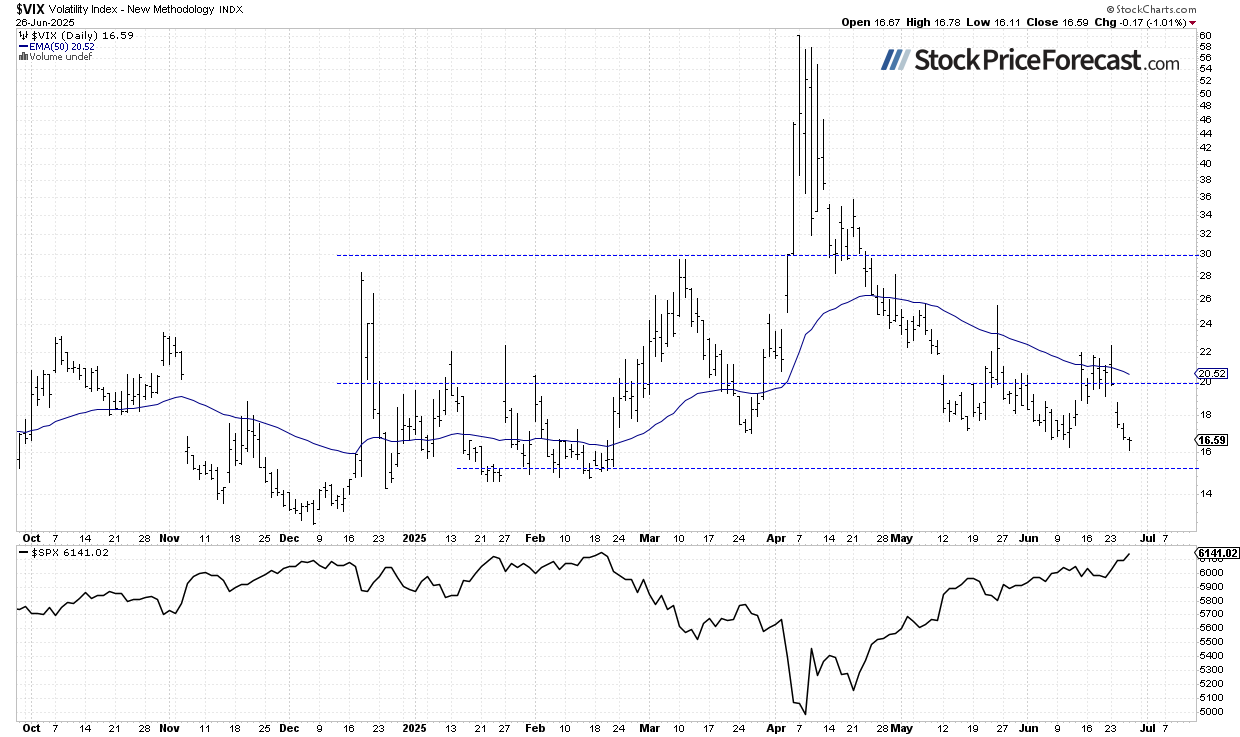

Volatility drops further

The Volatility Index (VIX) fell to a local low of 16.11 on Thursday – the lowest level since February 21 – confirming the recent equity rally and signaling calmer market conditions.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

S&P 500 futures contract: Above 6,200

This morning, the S&P 500 futures contract is trading higher this morning, extending the market’s uptrend and reaching new all-time highs above the 6,200 level. Support is now around 6,150, marked by the recent consolidation area.

Markets remain highly sensitive to geopolitical developments and could stay volatile in the near term.

Conclusion

The S&P 500 is set to open 0.3% higher today, likely breaking its February 19 record and fully recovering from the earlier tariff-related sell-off.

I think that in the short term, overbought technical conditions may lead to a period of consolidation or a mild pullback. However, no clear bearish signals are currently evident.

Here’s the breakdown

- The S&P 500 has reached its highest level since February, nearing the record high and extending gains for those who bought based on my Volatility Breakout System.

- There are no clear bearish signals yet, but a deeper downward correction is not out of the question at some point.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Read the full article here