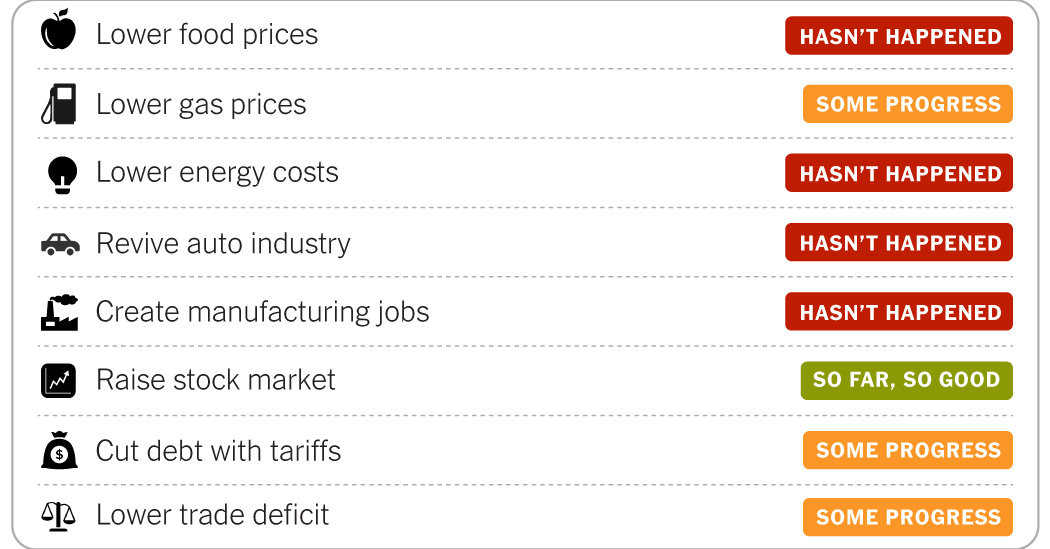

President Trump campaigned in 2024 on promises to “end inflation,” bring back manufacturing jobs and deliver an economic boom. A year after he returned to the White House, he has yet to deliver on those pledges. Still, there has been progress in some areas, and the economy has proved surprisingly resilient.

Here are eight of the promises Mr. Trump made as a candidate, and where things stand after his first year back in office.

Food Prices

Prices are down for a few specific grocery categories, like eggs, but are up sharply in others, like beef. Overall, food inflation has slowed significantly since peaking in 2022, but it has actually picked up somewhat since Mr. Trump returned to office — December saw the biggest one-month increase in grocery prices since 2022.

Mr. Trump often went even further on the campaign trail, promising to “bring down the prices of all goods.” Economists say that was never credible — and, indeed, outright declines in prices, known as deflation, are generally a sign of a deep economic slump. But they say inflation might have cooled more this year if Mr. Trump hadn’t imposed tariffs on a broad range of imported goods.

Gas Prices

Gas prices have fallen under Mr. Trump, though not to the sub-$2 level that he promised on the campaign trail. The average price of a gallon of regular gasoline was $2.78 in early January, according to the Energy Information Administration, down from just over $3 a year earlier. Gas prices hit a record high of more than $5 a gallon in the wake of Russia’s invasion of Ukraine in 2022, but had fallen significantly even before Mr. Trump returned to office.

Energy experts generally say presidents have little control over the price of oil. The major factors driving the recent decline, including robust domestic oil production, were in place long before Mr. Trump returned to office, although his trade policies may also have played a role by leading to lower forecasts for global growth. Still, prices at the pump are the lowest they’ve been in nearly five years.

Electricity Prices

Campaign rally in Asheville, N.C., Aug. 14, 2024

“Under my leadership, the United States will commit to the ambitious goal of slashing energy and electricity prices by half, at least half. We intend to slash prices by half within 12 months, at a maximum 18 months.”

Hasn’t happened

Unlike gasoline, the electricity market is extremely regional, with different parts of the country paying sharply different prices for power. On average, however, residential electricity prices in December were up 6.7 percent from a year earlier, and have risen far more in some areas.

Power prices are being driven in part by rising demand from the data centers used to train and run artificial intelligence models. That has created a political liability for Mr. Trump, whose administration has embraced the A.I. boom. Rising electric bills were a major issue in gubernatorial races last year, and are expected to feature heavily in midterm campaigns this year.

The Auto Industry

U.S. auto production peaked in the mid-1980s and has fallen steadily since then. That decline showed little sign of reversing during Mr. Trump’s first year back in office. Globally, U.S. carmakers have lost ground to foreign competitors, particularly Chinese companies specializing in affordable electric vehicles. Employment in the automaking sector has fallen by about 28,000 jobs in the past year.

Manufacturing Jobs

Campaign speech in Savannah, Ga., Sept. 25, 2024

“This new American industrialism will create millions and millions of jobs, massively raise wages for American workers, and make the United States into a manufacturing powerhouse like it used to be many years ago.”

Hasn’t happened

Manufacturing employment was roughly flat in Mr. Trump’s first few months back in the White House, but has now fallen for eight straight months. Wage growth for rank-and-file factory workers also slowed in 2025.

Mr. Trump’s supporters say it will take time for his trade policies to translate into factory jobs. But critics note that investment in factory construction, which should respond more quickly to policy changes, has also fallen.

Stock Market

NRA event in Dallas, May 18, 2024

“We are a nation whose stock market’s continued success is contingent on MAGA winning the next election.”

So far, so good

Mr. Trump’s first year was a wild one for the stock market. At one point last spring, the S&P 500 closed down nearly 18 percent from its peak, narrowly avoiding the 20 percent drop that is the conventional definition of a bear market. But despite several other jittery moments, stocks ended 2025 up 16 percent, making it a strong year.

Some of the ups and downs were the direct results of Mr. Trump’s policies. Stocks fell more than 10 percent in two days in early April after Mr. Trump announced tariffs on nearly all U.S. trading partners. They rallied by nearly as much when Mr. Trump rolled back many of those tariffs a few days later.

But the driving force behind the market gains was investor optimism about artificial intelligence. Companies tied to the A.I. boom saw their stock prices soar, even as some other sectors lagged. That increasing concentration has fueled concerns that the bull market could be vulnerable if A.I. proves to be a bubble.

Tariff revenue

Campaign rally in Juneau, Wisc., Oct. 6, 2024

“We will use the hundreds and billions — it’s really trillions, OK, but we’re going to use the hundreds of billions — of tariff dollars to benefit American citizens and to pay off debt because we have to start paying off debt.”

Some progress

The U.S. Treasury collected a record $264 billion in tariff revenue in 2025, more than three times the total in 2024. In November, the Congressional Budget Office estimated that the tariffs would bring in about $2.5 trillion in revenue through 2035, about half as much as the corporate income tax. That assumes the tariffs remain in place, however — the Supreme Court is considering a legal challenge that could invalidate some of the duties.

Even if tariffs remain in place, the debt will continue to grow because tariffs won’t fully offset the lost revenue from the tax cuts that Mr. Trump signed into law last year. That bill will add $3.4 trillion to the deficit over 10 years, according to the Congressional Budget Office.

Trade deficit

As a candidate, Mr. Trump promised his tariffs would discourage imports and encourage companies to shift production back to the United States, shrinking the trade deficit. In his first months back in office, the opposite occurred: The trade deficit exploded as companies rushed to import goods to get ahead of tariffs.

Imports dropped off sharply once Mr. Trump’s trade policies took effect, narrowing the deficit significantly late in the year. But imports could pick up again once companies sell through their inventories, and there has been little evidence of companies moving production back to the United States in a major way.

China is a somewhat different story. The U.S.-China trade deficit peaked during Mr. Trump’s first term and has declined since then, as both the Trump and Biden administrations imposed tariffs and other restrictions on trade with China. But some Chinese companies are routing trade through other countries to avoid U.S. duties, making it hard to estimate exactly how much imports from China have fallen.

Read the full article here