With expectations mixed (Services down, Manufacturing up) amid a rebound in ‘hard data’, preliminary January PMIs moved as expected but with considerably more magnitude.

-

S&P Global US Manufacturing PMI jumped back above 50 (50.1) from 49.4 (better than the 49.8 expected).

-

S&P Global US Services PMI tumbled to 52.8 from 56.8 (well below the 56.5 expected).

Source: Bloomberg

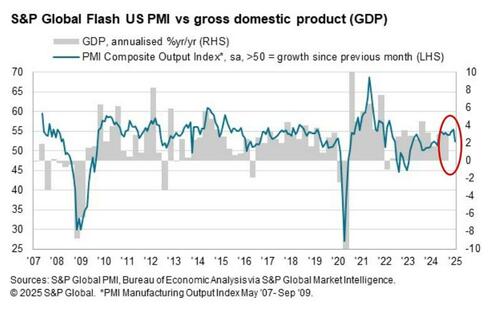

A return to growth in the manufacturing sector for the first time in six months was accompanied by sustained, but slower, service sector growth.

Firms’ expectations of output in the coming year meanwhile continued to run at a level not surpassed since May 2022, buoyed by optimism about the new government’s policies, encouraging firms to take on staff at the steepest rate for two-and-a-half years.

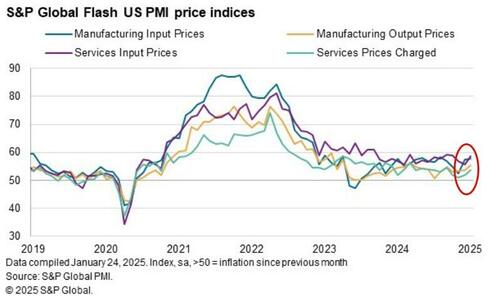

However, inflationary pressures intensified to a four-month high, with both input costs and selling prices rising at increased rates across both manufacturing and services.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“US businesses are starting 2025 in an upbeat mood on hopes that the new administration will help drive stronger economic growth. Rising optimism is most notable in the manufacturing sector, where expectations of growth over the coming year have surged higher as factories await support from the new policies of the Trump administration, though service providers are also entering 2025 in good spirits.

“Although output growth slowed slightly in January, sustained confidence suggests that this slowdown might be short-lived. Especially encouraging is the upturn in hiring that has been fueled by the improved business outlook, with jobs being created at a rate not seen for two-and-a-half years.

“However, rising price pressures are a concern, with companies reporting supplier-driven price hikes as well as wage growth amid poor staff availability. Higher input cost and selling price inflation was broad-based across goods and services and, if sustained, could add to worries that a combination of robust economic growth, a strong job market, and higher inflation could encourage a more hawkish policy approach from the Fed.”

So overall growth down but prices up… smells like stagflation taking hold.

Loading…

Read the full article here