Ether’s (ETH) impressive 85% gain in the past 30 days has surprised even the most bullish investors, and it makes the $800 range seen in mid-July seem like ages ago. Bulls now hope to turn $1,900 to support, but derivatives metrics tell a completely different story, and the data suggests that professional traders remain highly skeptical.

It’s important to remember that the leading cryptocurrency, Bitcoin (BTC), gained 28% in the same period. Thus, there should be no doubt that the Ether bull run was driven by the Merge expectation, a transition to a proof-of-stake (PoS) consensus network.

Goerli was the last remaining Ethereum testnet scheduled to implement the Merge, which officially became a proof-of-stake blockchain as of 1:45 UTC on Aug. 11. This final hurdle was completed with no major setbacks, giving a green light for the mainnet transition on Sept. 15 or 16.

There is a rationale behind investors’ booming expectations toward this major landmark transition. Such a multiphased upgrade aims for higher scalability and extremely low fees due to sharding, the parallel processing mechanism. However, the only change in the Merge is the complete removal of the burdensome mining mechanism.

In a nutshell, the equivalent inflation will be drastically cut as miners no longer need to be compensated by newly minted coins. Still, the Merge does not address the processing limit, or the amount of data that can be validated and inserted into each block.

For this reason, analysis of derivatives data is valuable in understanding how confident investors are on Ether sustaining the rally and heading toward $2,000 or higher.

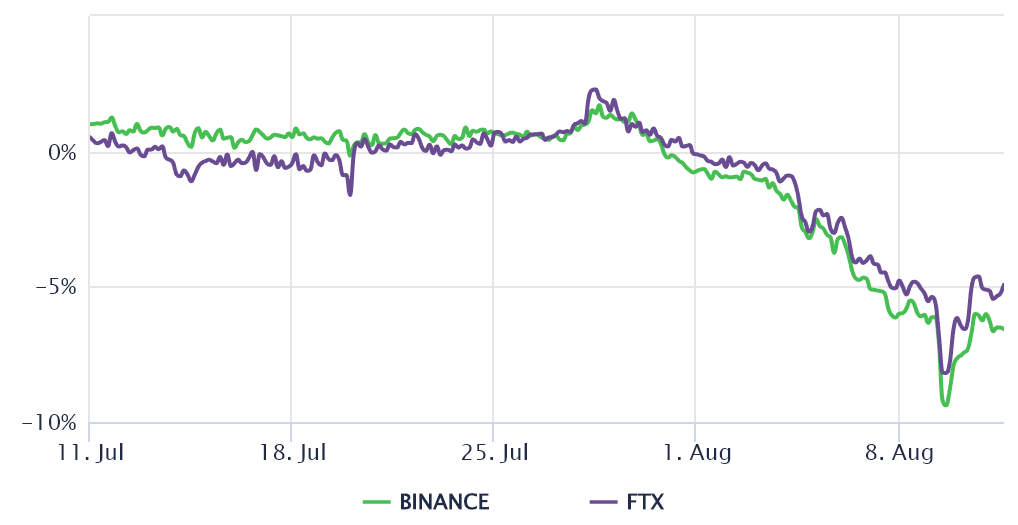

Ether’s futures premium has been negative since Aug. 1

Retail traders usually avoid quarterly futures due to their price difference from spot markets. Still, they are the professional traders’ preferred instruments because they prevent the perpetual fluctuation of contracts’ funding rates.

These fixed-month contracts usually trade at a slight premium to spot markets because investors demand more money to withhold the settlement. This situation is not exclusive to crypto markets. Consequently, futures should trade at a 4% to 8% annualized premium in healthy markets.

The Ether futures premium entered the negative area on Aug. 1, indicating excessive demand for bearish bets. Usually, this situation is an alarming red flag known as “backwardation.”

According to a post by Roshun Patel, former vice president at Genesis Trading, Ether futures have flipped into backwardation due to Ethereum “fork odds,” hinting that traders are offsetting their upside spot risks by taking bearish positions on futures contracts.

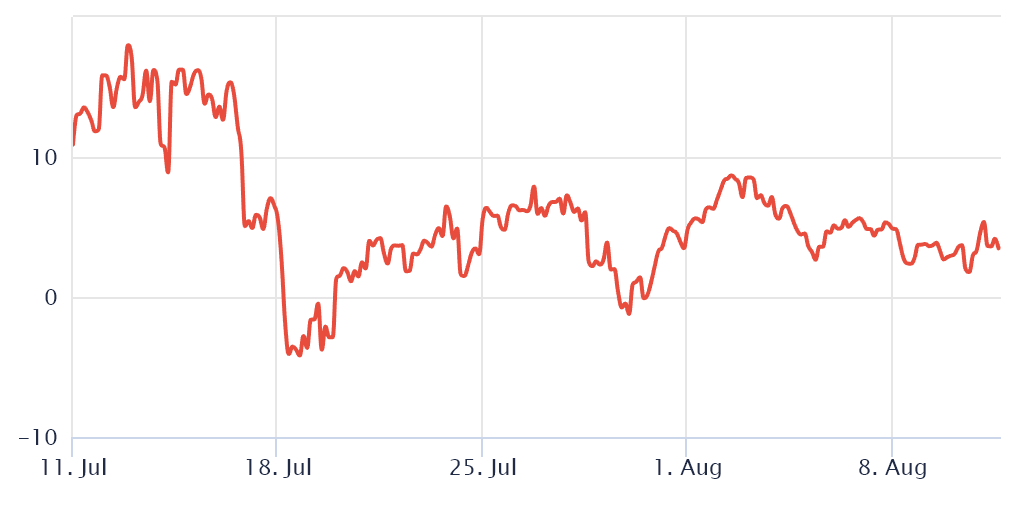

To exclude externalities specific to the futures instrument, traders must also analyze the Ether options markets. For instance, the 25% delta skew shows when market makers and arbitrage desks are overcharging for upside or downside protection.

In bullish markets, options investors give higher odds for a price pump, causing the skew indicator to fall below -12%. On the other hand, a market’s generalized panic induces a 12% or higher positive skew.

The 30-day delta skew bottomed at -4% on July 18, the lowest level since October 2021. Far from being optimistic, such numbers reveal traders’ unwillingness to take downside risks using ETH options. Not even the recent 85% rally instilled confidence in professional investors.

Traders expect full-blown volatility ahead

Derivatives metrics suggest that pro traders are not confident in ETH overtaking the $1,900 resistance anytime soon. Moreover, expectations for large volatile movements around the Merge date corroborate such a thesis. According to Mohit Sorout:

Strap in for the most notorious crypto play this year.

> Spot $eth buyers

> Hedging it with selling Dec futuresExpect full blown fuvkery around the merge pic.twitter.com/bu0zBaKZWC

— Mohit Sorout (@singhsoro) August 9, 2022

One thing is sure: Investors expect “free” coins following the potential proof-of-work fork. The question remains if the frenzy to unwind those futures trades will cause Ether to give back most of the 85% gains from the past 30 days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Read the full article here